Curated by Creandum in partnership with leading early-stage investors, solo GPs, angels, and seed funds across Europe, the Euro Seed 50 recognizes the continent’s most ambitious early-stage startups — the ones with the potential to become global, category-defining leaders. Selected from a competitive pool of nominations, these companies had raised up to a seed round at the time of judging. Each startup was chosen for its exceptional founding team, early product-market traction, and potential to transform large, underserved markets through bold innovation.

To deepen the signal, Specter identified and enriched them with a full stack of private market datapoints — from team moves and fundraising patterns to hiring trends and product momentum. By quietly aggregating thousands of fragmented signals, we surface breakout potential as soon as it starts to emerge.

Get Euro Seed 50!

Already a Specter user? Click here to explore the Euro Seed 50 🚀

Not on Specter yet? Download the list and get in touch to access the full dataset 📥

United Kingdom - Top 5

Fractile (🌟 Specter - Global Rank 243)

London-based Fractile emerged from stealth in July 2024 with a $15m seed round. The team—ex-Amazon and Oxford alumni engineers Walter Goodwin and Yuhang Song—are building an inference-optimised chip and software stack they claim runs 70–100× faster than today’s GPU clusters for large-language-model workloads. A first 5 nm prototype taped-out with TSMC is slated for Q4 2025, and Fractile is already piloting with UK fintechs to slash LLM infra bills.

Anam (🌟 Specter - Global Rank 1,732)

Anam raised a $2.5m pre-seed round in October 2024 (Concept Ventures, Fly Ventures, Scott Belsky) to bring photorealistic AI “personas” to customer support flows. The startup’s diffusion-based avatar engine launched in closed beta with Revolut in May 2025 and is averaging a 32 % reduction in chat-handling time. Co-founders Ben Carr and Caoimhe Murphy plan US expansion later this year.

Tracebit (🌟 Specter - Global Rank 2,114)

Tracebit plants lightweight “canaries” in cloud infrastructure to detect intrusions within seconds. The company closed a $5m seed led by Accel and Trellix CTO Ashar Aziz in July 2024 and has since doubled ARR to £1.4 m by adding Kubernetes honeypots and AWS Fargate support. Recent wins include Monzo Bank and UK MOD’s Defence Digital unit.

Ankar AI (🌟 Specter - Global Rank 3,904)

London-based Ankar lets enterprises discover, protect and monetise R&D with a stack of AI agents trained on legal and scientific corpora. Founded in 2024 by ex-Palantir duo Tamar Gomez and Wiem Gharbi, it closed a £3 million seed round on 28 May 2025 led by Index Ventures, with angels Olivier Pomel (Datadog) and Julien Chaumond (Hugging Face). Funds are earmarked for product expansion and GTM hires as patent filings hit record highs in Europe.

Arondite (🌟 Specter - Global Rank 5,606)

Arondite is building Cobalt, an AI “communication layer” that lets disparate autonomous defence systems inter-operate safely. The London startup raised $9.7m seed on 2 Apr 2025 (First Spark, Index Ventures, Concept Ventures, Creator Fund) and now supports human-machine teaming pilots with the UK MOD. Co-founders Will Blyth (ex-Army major) and Rob Underhill are doubling R&D headcount to harden the platform for NATO-grade deployments.

The Netherlands

Duna (🌟 Specter – Global Rank 347,405)

Amsterdam-based Duna is rebuilding business onboarding and compliance for an AI-first world. Founded in 2023 by former Stripe leaders Duco van Lanschot and David Schreiber, the platform turns fragmented KYC/KYB checks into a shareable “business identity” layer that cuts manual reviews and lifts conversion. In 6 May 2025 the startup secured a €10.7m ($12.1m) seed round led by Index Ventures, joined by execs from Stripe, Adyen and Snowflake; the capital is earmarked for expanding the Amsterdam product hub and building a pan-European identity network. Early enterprise adopters reportedly include Plaid, Bol.com and Moss, signalling strong traction in heavily-regulated fintech segments.

Sweden

Polar (🌟 Specter – Global Rank 26)

Open-source billing platform Polar is turning indie devs into “one-developer unicorns”. On 18 Jun 2025 it closed a $10m seed led by Accel with angels from Vercel, Shopify and Supabase backing the round, funding a remote-first team scaling out of Stockholm. More than 17k sign-ups and 5.3k GitHub stars since v1.0 (Sept 2024) show strong community pull, and early users report revenue growing “120 %+ MoM”. Founder Birk Jernström (ex-Shopify, Tictail) is hiring senior engineers and a Chief of Staff as Polar races to ship usage-based billing tools for AI-native software.

Tandem Health (🌟 Specter – Global Rank 312)

Founded in 2023 by clinician-turned-CEO Lukas Saari, Tandem automates clinical note-taking with an AI “ambient scribe” used by 1 000+ healthcare sites across Europe. A $50m series a on 30 Jun 2025, led by Kinnevik with Northzone, Amino Collective and Visionaries Club, bankrolls expansion into Italy and new GDPR-compliant “medical ChatGPT” features. Headcount jumped from 5 to 50 in 12 months and is set to double again as Tandem positions itself as the AI operating system for clinics.

Vesence (🌟 Specter – Global Rank 1,847,878)

YC (S25) legal-tech upstart Vesence turns Microsoft Word into an IDE for contracts. Bootstrapped to date, the Stockholm duo Henrik Hansson and Ludvig Swanström spent months living inside a top law firm to fine-tune AI agents that lint cross-references and flag deal-document inconsistencies. First enterprise rollout is live and early user quotes hail time-savings of “four hours per document”. With inbound interest from investment banks and consultancies, Vesence is courting design-partners while weighing seed options.

Strawberry (🌟 Specter – Global Rank 1,905,223)

Strawberry is an AI-native browser born in Stockholm that embeds autonomous “Companion” agents to research, summarise and automate web workflows. The fully bootstrapped team – Charles Maddock, Arian Hanifi and Sebastian Thunman – launched a pre-beta on Product Hunt in early 2025, earning a 4.9★ rating and “Product of the Day” honours. With no external funding yet, Strawberry is running paid subscriptions ($30 / month) while relocating part of the team to San Francisco to accelerate hiring and a public beta.

Spain

Omnia (🌟 Specter – Global Rank 1,855,517)

Madrid-based Omnia is a bootstrapped generative-engine-optimisation platform that lets brands track how they surface inside AI answers from ChatGPT, Gemini, Perplexity and other LLM-powered tools, then suggests content tweaks to improve citations. The company was founded in 2024 by Daniel Espejo—formerly a product lead at Klarna—who announced he was “going all-in on Omnia” earlier this year. A self-serve version with tiered pricing (€79–€999 per month) launched in March 2025, and the team is now hiring a senior back-end engineer to scale its real-time scraping and analytics pipeline.

Cala AI (🌟 Specter – Global Rank 1,894,219)

Barcelona-based Cala AI (founded 2025) is developing explainable-AI data pipelines that let corporates fuse internal data with public sources while maintaining audit trails. Co-founders Elisenda Bou-Balust and Issey Masuda Mora were Apple Media Knowledge leads; they have bootstrapped the venture to a 6-person R&D team.

Afori (🌟 Specter – Global Rank 4,218)

Afori (Barcelona, stealth mode) positions itself as an “agents-for-insurance” orchestration layer: think OpenAI Agents fine-tuned for underwriting workflows. The landing page (afori.com) opened in June 2025 and lists a wait-list. Founding team and funding are undisclosed. Afori aims to automate multi-carrier quotes for SMEs.

Slovenia

Sunrise Robotics (🌟 Specter – Global Rank 45,285)

Ljubljana-based Sunrise Robotics is building simulation-trained, dual-arm robot cells that can be deployed on a factory line in under ten weeks—versus the eight-month lead-times common in traditional industrial automation. Founded in 2023 by serial entrepreneurs Tomaz Stolfa (vox.io, Layer), Marko Thaler (Airnamics) and Joe Perrott (ex-PCH International), the startup emerged from stealth on 13 June 2025 with an $8.5m (€7.3m) seed round led by Plural, joined by Seedcamp, Tapestry VC, Tiny.vc and Prototype Capital.

Lithuania

nexos.ai (🌟 Specter – Global Rank 5,620)

Founded late 2024 by Tomas Okmanas and Eimantas Sabaliauskas—Vilnius-based nexos.ai is building the “AI gateway” for enterprises: a single API that routes traffic across 200-plus large-language-model endpoints, applies smart fallback logic, and gives teams one console for usage, spend, and compliance. Emerged from stealth on 17 Jan 2025 with an US $8m seed led by Index Ventures, joined by Creandum and Dig Ventures, plus angels such as Datadog’s Olivier Pomel and Supercell’s Ilkka Paananen.

Germany - Top 5

Langfuse (🌟 Specter - Global Rank 117)

Open-source LLM-observability suite used by 1,800+ dev teams to trace, eval & optimise prompts in production. The Berlin-born project closed a US $4m seed round (7 Nov 2023) led by Lightspeed, La Famiglia and Y Combinator, funding a shift from dashboards to guard-rail automation. The team (ex-Klarna engineers Clemens Rawert, Marc Klingen & Max Deichmann) recently crossed 3k GitHub stars and launched a “feedback loop” API adopted by Adevinta and Picnic.

juna.ai (🌟 Specter - Global Rank 1,815)

Founded 2023 by Matthias Auf der Mauer (ex-AiSight exit) and Christian von Hardenberg (ex CTO Delivery Hero), Juna builds self-learning AI agents that tune heavy-industry lines for energy, yield and CO₂. The company surfaced from stealth in Nov 2024 with a US $7.5m seed led by Kleiner Perkins and Norrsken VC; proceeds go to field trials at a German steel mill and a chemicals site in NRW. Early pilots show 8-12 % energy cuts per furnace cycle.

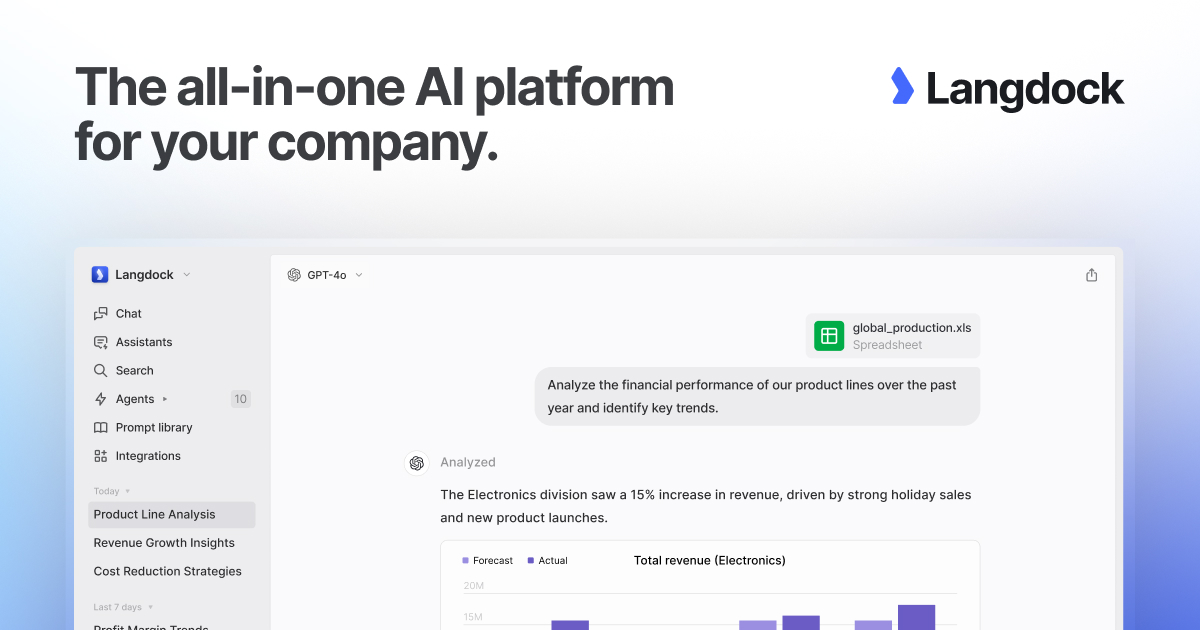

Langdock (🌟 Specter - Global Rank 2,804)

Langdock positions itself as the EU-compliant “workspace for GenAI at scale.” Its chat interface lets employees query multiple LLMs while keeping data residency inside German clouds. In April 2024 the Berlin startup banked US $3m seed from General Catalyst, La Famiglia and a pre-seed from Y Combinator. Customers include Merck, which rolled the tool to 63k staff, and logistics-unicorn Forto. Road-map: SOC 2 Type II and a plugin marketplace for domain-specific agents.

Superscale AI (🌟 Specter - Global Rank 5,121)

Founded by Patrick Häde, Selina Huber, David Pflugpeil and Lukas Minnebeck, Superscale promises an “AI CMO” that auto-generates, launches and optimises multi-channel ads from a single product URL. The Berlin team raised US $5m pre-seed (Jun 18 2025) led by Creandum with angels from OpenAI and Anthropic. Over 1 000 companies joined the wait-list within two weeks; the roadmap adds agentic landing-page tests next.

Integral (🌟 Specter - Global Rank 6,580)

Integral, launched in 2024 by fintech repeat-founders Lukas Zörner and Anil Can Baykal, bundles accounting, payroll and tax into an AI-powered, advisor-backed platform for German SMEs. The company banked €6.3m (≈ US $6.5m) pre-seed on Feb 12 2025 from General Catalyst, Cherry Ventures and Puzzle VC. Funds go to expanding the Berlin engineering hub and onboarding the first 150 pilot firms.

France - Top 5

Dash0 (🌟 Specter – Global Rank 238)

OpenTelemetry-native observability has a new champion in Dash0. Founded in 2023 by former Instana and Snyk engineers Mirko Novakovic, Ben Blackmore, Miel Donkers & Marcel Birkner, the Solingen- and Paris-based startup raised $9.5m seed funding (5 Nov 2024) led by Accel with Dig Ventures plus angels from Vercel and Snyk. The platform lets developers ingest metrics, logs and traces in one place while paying “just for the telemetry you care about.” Funding is fuelling a European go-to-market push and an enterprise tier with cost-control features built on PromQL.

Linkup (🌟 Specter – Global Rank 3,481)

Paris-based Linkup is building the “agentic web” — APIs that give AI systems fast, ethical access to premium online content without scraping. The 2024 spin-out was co-founded by Philippe Mizrahi, Denis Charrier and Boris Toledano (ex-Spotify, Lyft, McKinsey) and raised €3m pre-seed in Nov 2024 from Seedcamp, Axeleo, Motier Ventures, Kima Ventures and OPRTRS Club. Funds are earmarked for data-partnership deals and scaling a usage-based pricing model for LLM developers.

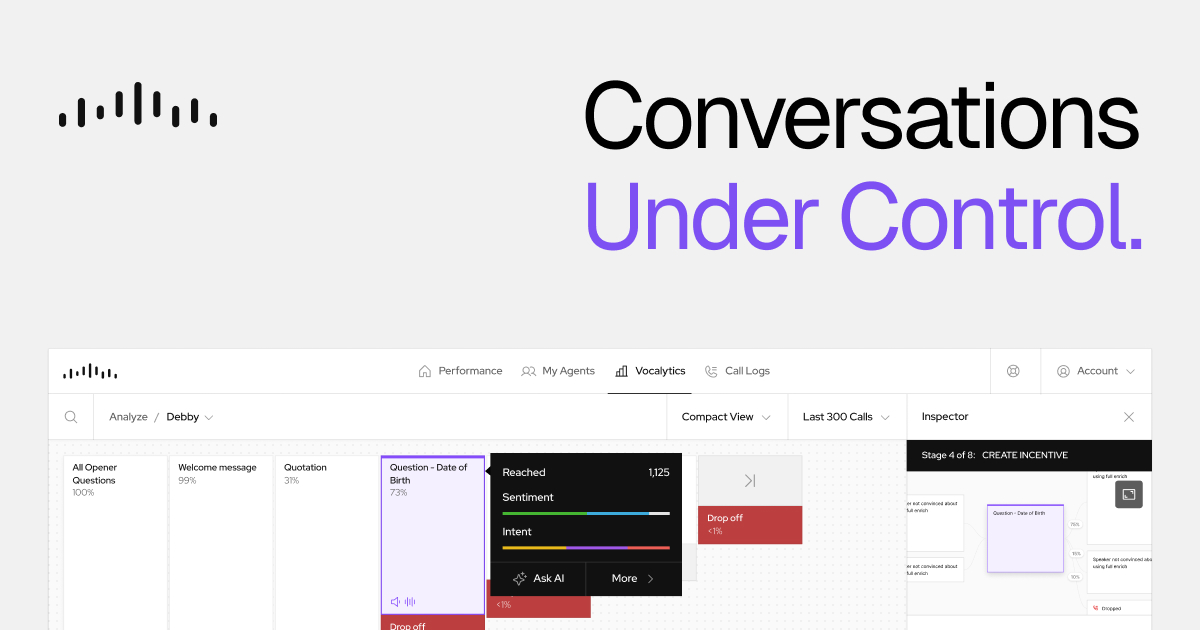

GetVocal AI (🌟 Specter – Global Rank 4,782)

GetVocal AI turns cold calls into warm leads with voice agents that learn and iterate after every conversation. The startup exited stealth on 29 Jan 2025 with a €2.7m pre-seed led by Speedinvest and Elaia, plus a strategic rollout deal with outsourcing giant Capita. Co-founders Roy Moussa (CEO) and Antonin Bertin (CTO) tout a proprietary “Conversational Map” graph that lets companies dial the agent’s creativity up or down for compliance. The 14-person, remote-first team anchors R&D in Paris and claims pilots in banking and utilities.

The Mobile-First Company (🌟 Specter – Global Rank 14,068)

The Mobile-First Company wants to give SMBs “one-task, one-tap” apps that replace spreadsheets. Launched in Mar 2024 with a €3.5m pre-seed led by Lightspeed Venture Partners and Emblem, the firm was co-founded by Jérémy Goillot (ex-Spendesk Head of Growth) and Ignacio Siel Brunet (former VP Engineering at Pomelo). First product Allô hits AI-summarised call logs, while ScanToSheets automates data capture. The team reports 100k+ cumulative downloads and is hiring React-Native engineers in Paris.

Plakar (🌟 Specter – Global Rank 27,335)

Open-source backup gets a developer-first reboot with Plakar. Parisian engineers Julien Mangeard and Gilles Chehade raised $3m pre-seed on 15 May 2025 from Seedcamp, Kima Ventures, Motier Ventures and angels Datadog’s Olivier Pomel & Docker’s Solomon Hykes. Plakar’s container-like “Kloset” snapshots deduplicate, encrypt and make data instantly queryable — turning cold backups into AI-ready datasets. A CLI hit 4k GitHub stars in six weeks; stable v1.0 shipped alongside the funding news.

Denmark

All Gravy (🌟 Specter – Global Rank 2,951)

Copenhagen-based All Gravy builds an all-in-one employee “super-app” for frontline teams in hospitality and retail—bundling communication, shift scheduling and instant earned-wage access into a Gen-Z-friendly interface. Founded 2020 by Jonatan Marc Rasmussen and Kristian Lundager, the startup closed a €2.6m seed round (≈ $2.9m) on 28 Mar 2025, co-led by Scale Capital and Moonfire Ventures. All Gravy positions itself as an “operating system” for the 80 million European shift workers still stuck with legacy POS add-ons and spreadsheets.

Strategic Outlook

Europe’s next wave of seed-stage winners is coalescing around special-purpose AI infrastructure and domain-expert agents, rather than general-purpose chatbots. Hardware breakthroughs (e.g., Fractile’s inference-optimised chips) sit alongside open-source observability (Langfuse, Polar) and orchestration layers that keep sensitive workloads inside European clouds (Langdock, nexos.ai).

At the same time, vertical stacks are emerging for regulated or understaffed sectors—healthcare (Tandem), defence (Arondite, Sunrise Robotics), frontline labour (All Gravy) and financial compliance (Duna). Investors from both sides of the Atlantic—Lightspeed, Accel, Index, Kleiner Perkins—are writing ever-larger seed cheques ($8m–$15m is the new normal) to capture first-mover advantage before enterprise AI budgets harden around a handful of platforms.

Expect continued consolidation around open telemetry standards, more dual-use spin-outs serving defence and civil markets, and intensifying competition for the scarce pool of EU talent with silicon, safety and agent-framework expertise.

Key Takeaways

- LLM cost & control are the new battlegrounds – startups like Fractile (custom silicon) and nexos.ai (routing gateway) aim to slash inference bills and vendor-lock risk.

- Vertical AI agents win on domain knowledge, not model size – Tracebit’s canary honeypots and Anam’s photoreal personas show that narrow, high-ROI use-cases secure quick pilots and revenue.

- Open-source remains a distribution super-power – Polar (billing) and Langfuse (observability) convert GitHub stars into paying users, allowing lean teams to compete with well-funded peers.

- Compliance-first positioning is non-negotiable in Europe – Langdock, Duna and Cala AI foreground EU data residency and audit trails, turning regulation into a moat.

- Defence and critical infrastructure are being “software-defined” – Arondite and Sunrise Robotics reflect governments’ willingness to back native tech for autonomous coordination and factory automation.

- Seed rounds keep swelling despite macro headwinds – Median raises in this sample cluster between $7m and $12m, suggesting dry-powder competition for top technical founders.

- Bootstrapped outliers signal alternative paths to scale – Strawberry (AI browser) and Vesence (legal IDE) prove that product-led traction can precede venture funding, especially in niche workflows.

- Talent gravitation towards AI tooling – Ex-DeepMind, Palantir, Stripe and Apple engineers are leaving incumbents to start companies, accelerating knowledge transfer into the startup ecosystem.

🔹 Explore the full the Euro Seed 50 Landscape →

These insights are just the beginning. Discover 1,000+ more European innovators and emerging trends on Specter.