inDrive New Ventures is the corporate venture arm of the second most downloaded ride-hailing platform worldwide, with over 150 million users in 49 countries. inDrive’s expansive global presence gives them the upper hand in finding the next generation of high-growth startups across emerging markets, finding synergies with the local ecosystems in which they already operate at scale.

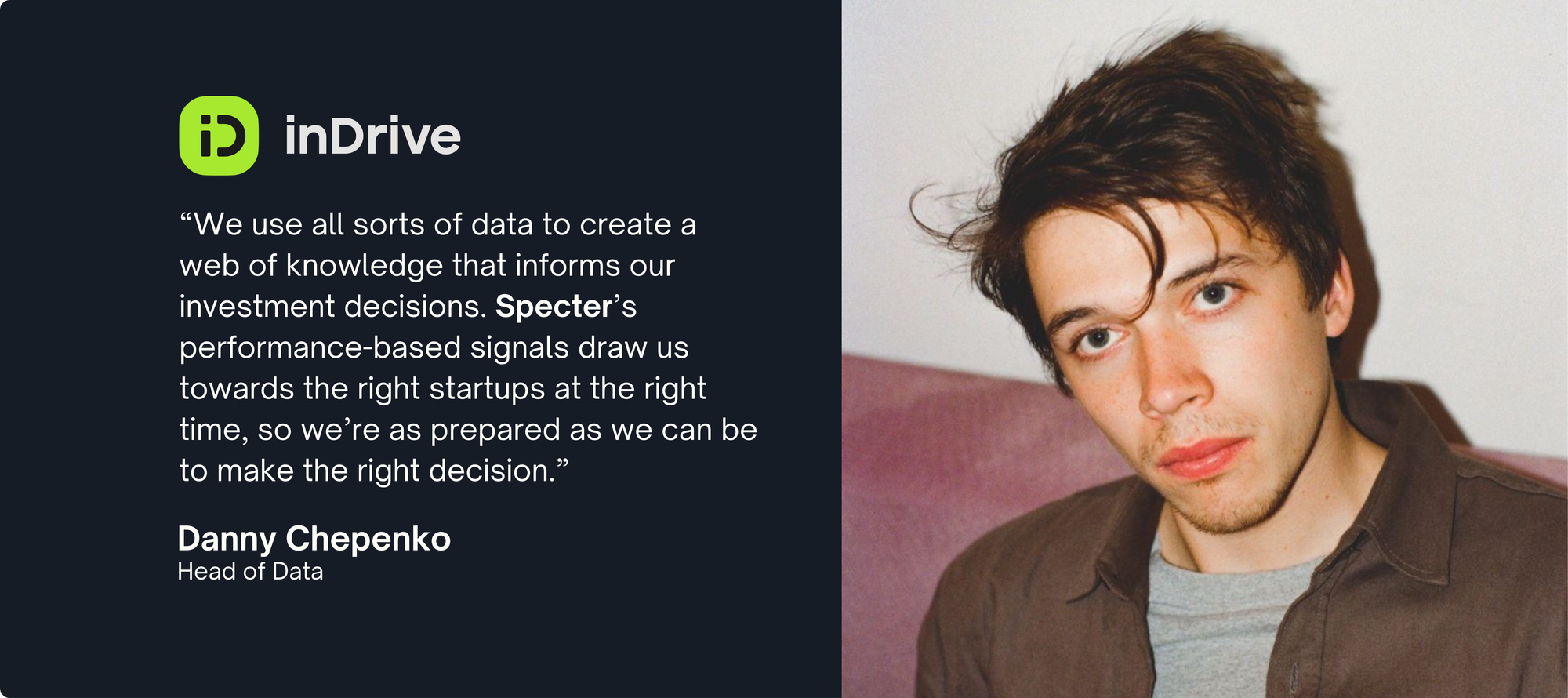

Danny Chepenko is responsible for all things data-driven as Head of Data Science at the fund. We spoke with him to understand how he uses Specter to build innovative data-driven investment strategies from the ground up, and seek out the best founders shaping the future of mobility, urban infrastructure, digital economies and beyond.

Feedback Loops: Data as an Investment

Danny’s background spans data engineering and entrepreneurship, with a Masters degree in Data Science and two startups under his belt. This combined founder and technical experience nurtured his passion for both spheres, and drew him to the world of data-driven VC.

As one of the first hires, he has seen how the team’s dynamics and decision making have grown and evolved over time, while also getting involved in calls with founders and writing memos himself. He emphasised the importance of not distancing the data and investment functions.

“Being immersed in the day-to-day of the investment team, analysing the opportunities we’re assessing and understanding how the scoring and screening model impacts our outcomes, is of vital importance. This exposure encourages the feedback loop, and helps me understand the strengths and shortcomings of our models, so I can iterate on them and make improvements.”

Danny has orchestrated their own warehouse to gather data from various places, using Specter as a master source, and combining this with any additional data to develop different views of each startup. The internal transformation piece involves merging a range of data on pageviews, headcount, app downloads, retention and other metrics. In addition to having full programmatic control of the data, it is also accessible through the Specter platform and integrations.

“Our leadership team supported the idea of creating a first in class data infrastructure from the outset. We’ve really invested in partnering with the most optimal providers and making a long-term commitment to excellence in the way we find and assess investment opportunities.

Specter contributes to this mission on several fronts. They provide extensive raw data to inform our models and strategic practice, while maintaining a high degree of searchability and connectivity with the frontend platform, browser extension, and integrations.”

‘Satellite Scouting’ in Emerging Markets

Danny’s data-driven operation becomes all the more important in the context of investing in ‘growth economies’. Scaling the team to invest in an ever growing number of developing markets and access opportunities from Brazil to Egypt, Peru to Indonesia and further afield, without being there on the ground, presents some challenges.

“Seeking companies in emerging markets is a different ball game, not only from the perspective of finding founders and pools of talent, but also because relatively speaking to the US and Europe, they can be underfunded. We don’t have Venture Partners in every location we target, nor would we want to restrict ourselves by where we do or don’t have a physical presence. So we have to find other ways to access these widespread locations.

Data-driven approaches give us a systematic, engineered way to monitor the markets we have an interest in, and act immediately when we see something is happening. Equally, we are open to broadening our purview to explore markets even beyond the wide scope we already target, and that’s where Specter becomes really useful to identify similar, relevant opportunities.”

Use Cases

As strategic investors, inDrive are keen to have conversations with anyone working in areas they are actively looking at and those tangential to the core business, for instance, affordable car ownership, car loans and subscriptions, or reused car marketplaces. These all sit within the scope of mobility, but the team also pushes to look at other business models demonstrating a high degree of relevance in specific regions of the world, with notable growth dynamics.

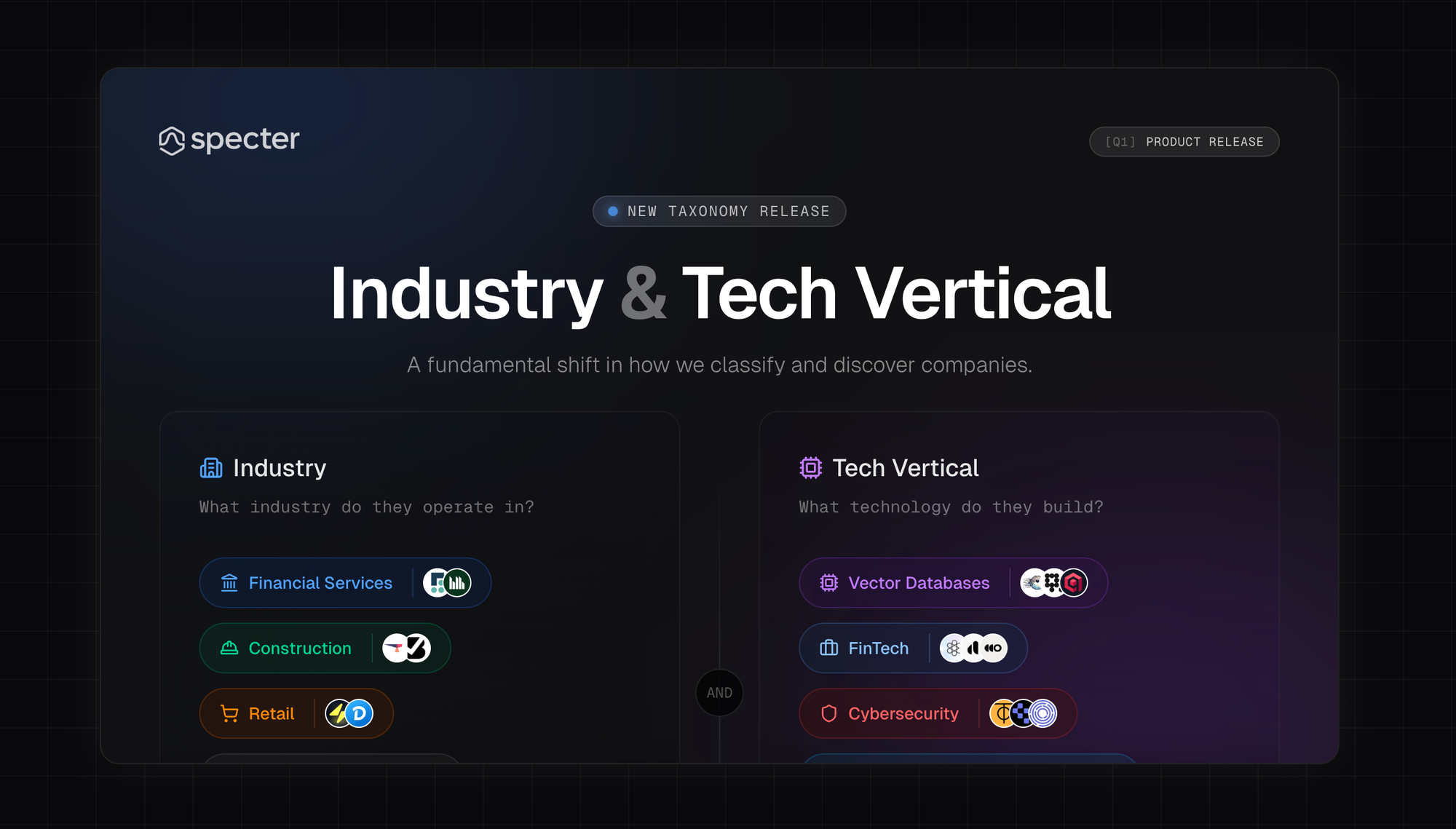

Company Signals help them identify startups operating in similar Industries and/or specific Locations of interest, attainable at a broad level using the macro filters on preset regions and sectors, and much more granularly where applicable.

“The essence of this product isn’t just tied to the informative company profiles — it’s the inherent value that comes from the signals themselves. Highlights based on company growth, headcount changes, website traffic surges, and investor interest are all helpful, especially with all the infinite combinations you can create in a few clicks.”

Our unique Customer Focus and Typical Customer Profile filters also help distinguish between B2B and B2C aimed businesses, as well as finding products geared towards helping certain demographics of users, such as drivers. This combined with quality web traffic data and the Specter Rank is highly impactful to identify outliers in their areas of interest.

“The latest Specter ranking is a good starting point for immediate prioritisation, but we always apply our own opinionated criteria to searches, so we have full visibility on everything we should look into further. Then, we can use each Company profile to get a 360 view on what’s needed, to decide if and how we pursue the opportunity”

Talent Signals are also helpful for network building and picking up on earlier indicators of potentially interesting startups.

“Our focus is mainly Series A+, but we still like to engage early with founders. It’s meaningful to be in each others’ sphere of influence, and as we increasingly invest in the digital presence of our brand, familiarising ourselves with the future generations of founders we will likely pursue at later stages in their growth journeys is impactful.

In emerging markets, companies that started 10 years ago will likely be great local donors of talent to startups, so it’s great that we can track their alumni through Specter and observe their professional movements.

We also look at reverse immigration trends, which for instance surface candidates who were raised in Colombia, then studied in the US and worked a couple of years in a Silicon Valley startup before founding their own venture. These are examples of pools of people we would deem highly relevant, and that the platform helps us track at scale.”

Not an Exact (Data) Science

Danny is a proponent of sharing his learnings with the wider venture community, and throughout the process of building from scratch inDrive’s venture-focused data infrastructure, he has formulated a well-informed stance on the benefits of their methodology.

“We don’t formulate tasks around the ‘100x exit’. Ultimately, relying on a sophisticated ML model to find the startup you want to invest in right away isn’t conducive to what we are trying to achieve. We see many companies that have interesting business models and focus on the problems they’re trying to solve in a compelling way.

Our incentives also differ to your typical VC, in that we’re open to looking at plateaued companies as well as those in the top percentile. This is often applicable in emerging markets, where mature companies can hit a saturation point. That’s when we can step in to help them scale.

At both ends of the scale, the tool helps us find companies that fit, and companies that don’t. Both result in outcomes where we educate ourselves on the market as a whole — and that’s beneficial, given that local ecosystems are deeply interconnected.

We build a symbiotic web of knowledge that informs our decisions cumulatively, and that way, when Specter’s performance-based signals draw us towards the startups we want to back, we are as prepared as we could possibly be to make the right decision.”