Picus Capital is an early-stage technology investment firm with a long-term investment philosophy. They have partnered with 180+ founding teams across more than 20 countries over the past 9 years. Their on-the-ground presence continues to grow beyond the firm’s roots in Munich, with a sizable 20+ member investment team supporting founders across North America, Latin America, Europe, and Asia.

Their expansion chimes well with the close of their second double-down fund announced in early 2024 at €250M, which is more than twice the size of its predecessor fund in 2021. This allows them to double down on their portfolio across growth rounds, scaling their highly valuable early stage offering of private, flexible, long-term balance sheet capital even further, by expanding their mandate across the capital stack.

Their global presence, coupled with access to such multi-stage long-term capital, helps them execute their unified strategy to find and invest in entrepreneurs building sustained category leaders that fundamentally ‘reimagine the way we live and work’. Abhijay and Claudius spearhead the firm’s ‘efficiency and alpha initiatives’. We sat with them to learn more about their approach to software enablement and using data to empower their investment team.

Firm Building with Data

The firm’s philosophy is imbued with a particularly strong sense of commitment towards the companies they partner with. They look at new opportunities even before Pre-Seed, and in line with their double-down investment thesis, follow-on across Series A-B rounds for much of their portfolio. Strategically, they are mission-aligned with the long-term success of a startup’s initial mission statement rather than any particular pre-defined exit timeline or horizon, Claudius explained:

“We embark on 10+ year journeys — sometimes even longer — with our portfolio founders, starting to work with them often even before the company is incorporated. This paves the way for lasting, highly operationally involved partnerships, and deep levels of trust that cultivate exceptional rapport with the founders we work with. We want to be there for our founders as their earliest believers and sparring partners, right from the moment their business idea was born.”

Harnessing data is at the heart of what allows Picus to operate at the scale and speed they do, using a range of solutions to drive not just firm-wide but also portfolio-wide impact.

“We require a level of coverage and swift access to insights that not many point solutions can provide across the investment cycle. As a result, our tech stack is a complex and continuously shifting combination of buy vs build, and we continuously look to bring the bleeding edge in technology to our team and our founders.”

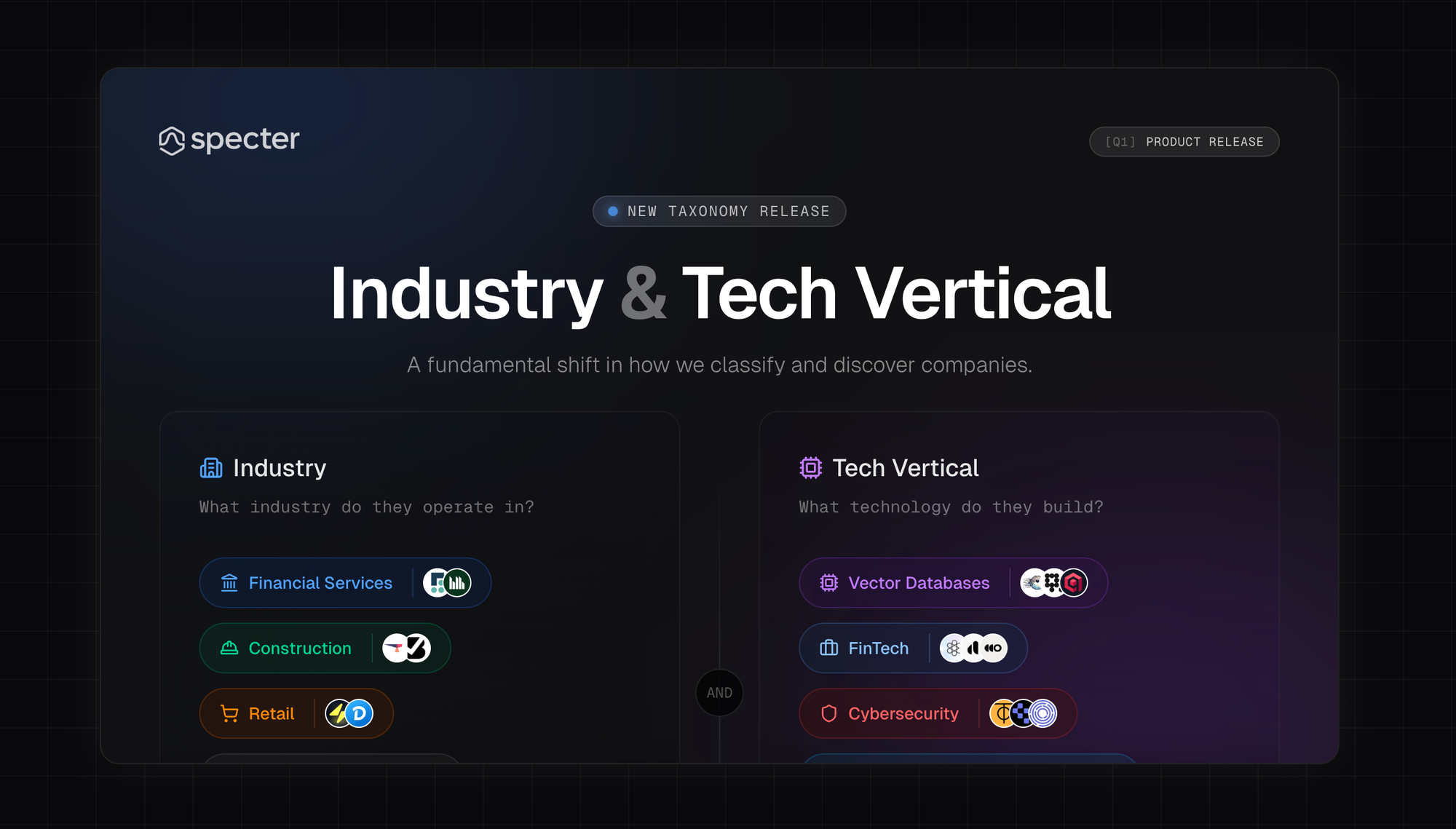

As such, Specter’s data and platform increase the team’s efficiency across multiple touchpoints:

- Identifying top founders: Focus on people making notable professional moves and having noteworthy interactions, rather than waiting for a company to be ‘created’ for it to be flagged, as with most incumbent investment databases.

- Network expansion: Build expert advisory networks based on promotions and people taking on new roles, outside of whether they are looking to start a business themselves.

- Market mapping: Identify growing regions and industries by crosschecking Company growth with hiring data in Talent Signals — or even observing multiple departures and companies pulling out of a region.

- Talent support: Superpowering portfolio companies by identifying interesting potential hires in Talent Signals.

- Follow-on fundraise support: Not be limited to co-investors that have already invested in spaces and could therefore be keen to follow-on in portfolio companies, but go one step further in intent signalling to those who are currently demonstrating intent to invest in a given space using Strategic Signals.

Leveraging these different kinds of data is at the heart of what allows the fund to tackle a wide range of use cases and scale in the process, using several ‘efficiency initiatives’ to drive firmwide impact.

Multipliers Enable Excellence

Abhijay is of the firm belief that efficiency and alpha generation are two core pillars to giving the team a sustained competitive advantage, applying what he calls a ‘multiplier’ to their rate of execution:

“Each team member has their own sourcing, diligence, and portfolio management responsibilities, amongst a range of other activities that are critical to the firm’s operations. Moreover, responsibilities extend across timezones, functions, and teams, making async access to information crucial to debottleneck decision making.

Specter enhances the efficiency of our operations via its easy to operate frontend, especially the Chrome extension, which is a massive timesaver to directly view datapoints in the browser rather than toggle multiple tabs. They also deeply contribute to our in-house data systems to generate alpha, via its easy-to-use API functionality. Covering both bases makes it a highly versatile and valued part of our tech stack.”

Processes Drive Alpha

Efficiency is important, but by itself doesn’t give you a unique edge or alpha. Efficiency is an accelerant that needs a direction vector, and this is what finding ‘alpha’ really means. Abhijay went on to outline:

“We believe that in the 2020s and 2030s, as technology accelerates, it gets more and more challenging to keep the entire mosaic in one’s mind. Having a consolidated institutional memory with enterprise AI search layered on top is invaluable. This acts as a single source of truth, and as a living memory of the firm’s collective hypotheses, decisions, and knowledge. This opens up multiple possibilities for data-driven thinking.”

He shared more details on what this looks like for the team in practice:

- The firm’s institutional memory is never lost. Any new team members can rely on data-driven tools like Specter to accelerate their learning curve and get up to speed on companies in record time. At the same time, they can absorb the codified intuition of senior investment team members who have directly seen multiple industry cycles, helping them to rely on digitally codified proof rather than the intermittent individual memory of their colleagues.

- Specter’s scoring helps train Picus’ proprietary multi-factor scoring algorithm. This algorithm is also frequently backtested to reveal any potential oversight in initial sourcing and subsequent decision making. Such data contributes to the firm’s learning curve over time, helping minimise subjectivity driven by individual heuristics, thereby reducing near misses and subsequent anti-portfolio cases.

- Qualitative interpersonal networks are data-enriched by public data providers such as Specter via API, in addition to proprietary CRM data. The firm adds its own specialised natural language queries on top of what is already searchable via Specter’s taxonomy and keywords in the verticalised UI. This helps them map individuals to the best introduction routes even more swiftly.

- Old investment hypotheses are stress tested against actual funding as well as revenue data to quantitatively assess whether they are panning out. New hypotheses emerge out of patterns seen in talent migrations and other such leading indicators as to what the best minds are working on.

To conclude, Abhijay and Claudius noted that Venture Capital is a full-stack industry. Just like startups who disrupt incumbents, the venture model is also prone to disruption in itself. The VC of 2035 cannot continue to operate like the VC of 2025.

“Building a venture capital firm of the future, will involve thoughtful bundling of cutting edge technological enablers with deep industry insights, global-first networks, and highly empowered teams. We look forward to continuing our work with players like Specter, who are pushing the boundaries of what is possible in data-driven VC.”