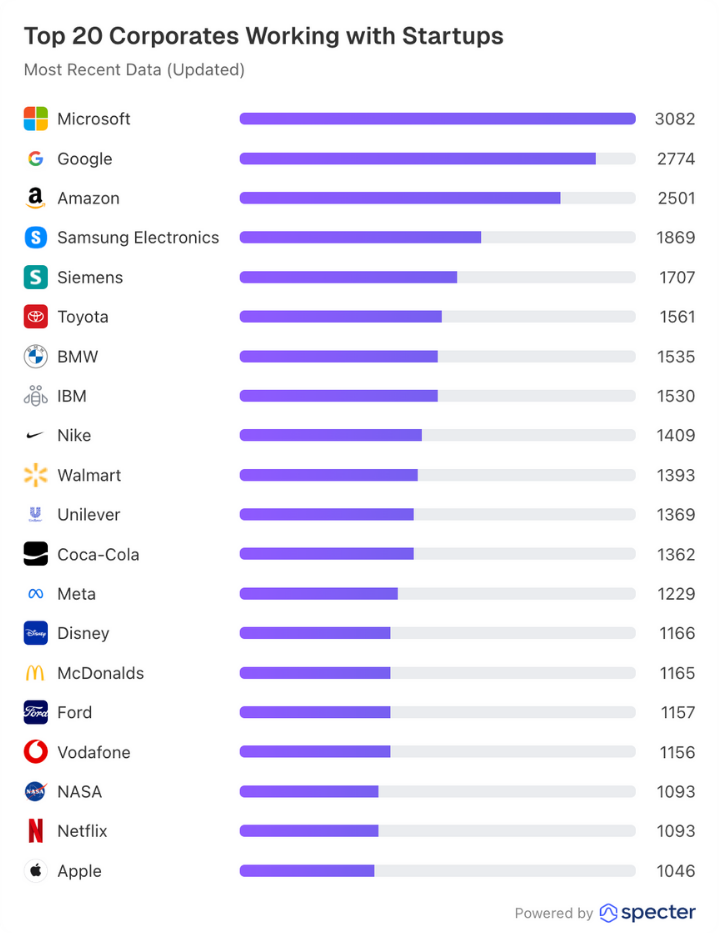

Startups thrive on strategic partnerships that fuel their growth—whether through funding, access to cutting-edge technology, or expansion into new markets. At the heart of this ecosystem are corporate clients who rely on startups for innovation, agility, and specialized solutions. By analyzing data from over 4 million startup websites, we identified more than 1.06 million startup-client relationships, shedding light on the corporates that engage the most with startups and the global distribution of these collaborations.

The Corporate Giants Leading the Way

Unsurprisingly, the world’s biggest tech firms are the largest clients of startups:

- Microsoft (3,082 startups) – The undisputed leader in corporate engagement, with thousands of startups providing services to Microsoft across cloud, AI, and enterprise software.

- Google (2,774 startups) – A major client for startups in digital advertising, AI tools, and cloud computing solutions.

- Amazon (2,501 startups) – AWS powers countless startups, but Amazon also engages startups as clients in logistics, e-commerce, and AI.

- Samsung, Siemens, and SAP – These firms rely heavily on startup vendors for industrial and enterprise technology solutions.

Beyond tech, JPMorgan Chase, Mastercard, and Visa feature prominently as some of the biggest startup clients, reinforcing fintech’s reliance on startup innovation. These financial institutions purchase cutting-edge startup solutions to enhance their digital services.

Pharmaceutical giants like Pfizer and Johnson & Johnson partner heavily in biotech and digital health startups. Energy companies such as Shell and BP work with green tech and sustainability-focused startups. Consumer goods companies, including Unilever and Nestlé, actively support food tech and supply chain innovation.

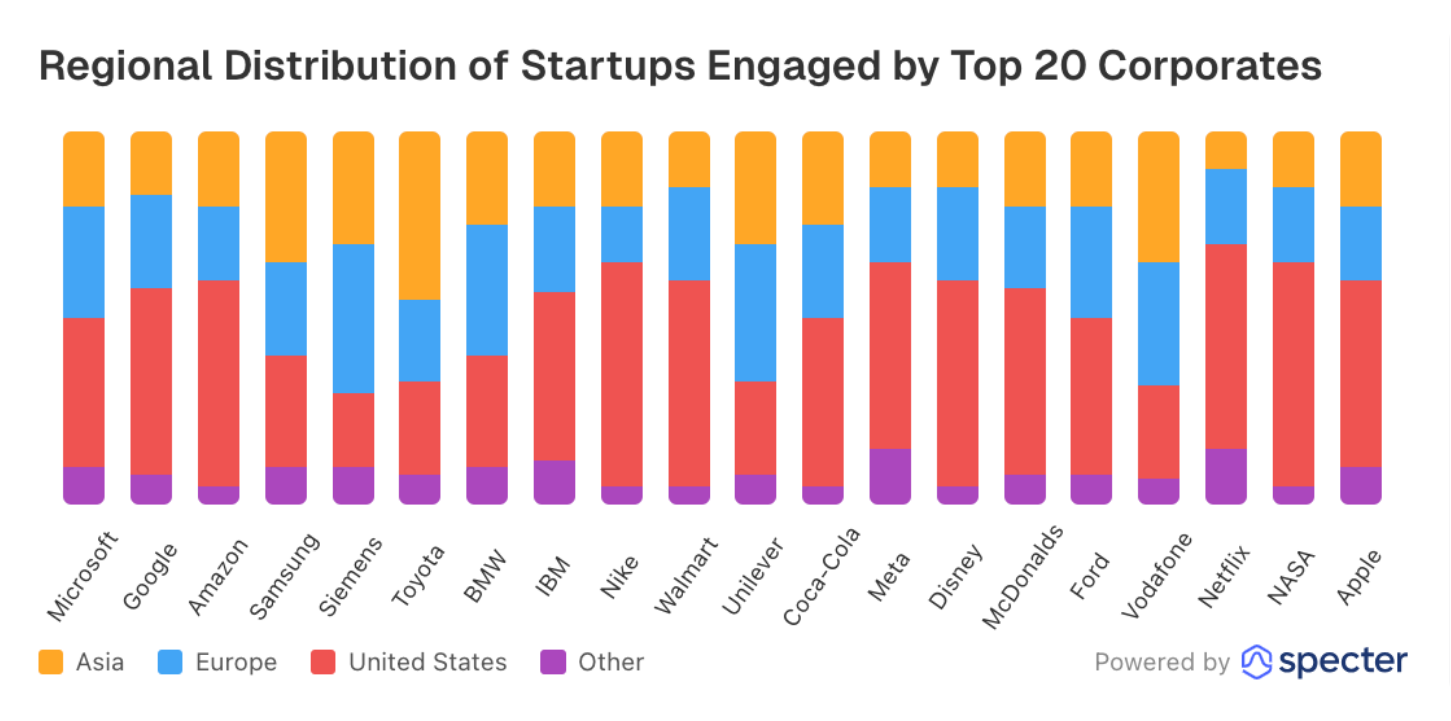

Where Are These Startups Based?

While the majority of startup collaborations for the leading corporates are based in the United States, significant regional differences exist:

- BMW and Volkswagen have a strong European focus, with over 50% of their startup vendors based in Europe.

- Google, Amazon, IBM, and Nike work with more than 50% U.S.-based startups, showing a strong preference for domestic innovation.

- Samsung Electronics maintains a globally balanced approach, with significant portions of its startup vendors coming from Asia (23%) and Europe (33%).

- PepsiCo and Shell exhibit a diverse regional mix, engaging with startups from Asia, Europe, and emerging markets in other regions.

Industry Breakdown: Where Are Startups Selling Their Services?

Across all corporates, the top industries where startups provide services include:

- Software & AI (Top-ranked) – The sheer demand for digital transformation drives software and AI startup-client relationships.

- Media & Marketing – Google and Facebook are major clients of startups offering advertising, analytics, and engagement solutions.

- E-commerce & Fintech – Amazon, Visa, and Mastercard purchase solutions from fintech and retail-tech startups to stay competitive.

- Industrial & IoT – Companies like Siemens and Bosch rely on startups to provide innovative manufacturing and smart infrastructure solutions.

Cool Brands & Their Startup Clients

While tech giants dominate, some globally recognized cool brands also actively engage with startups:

- Nike – Buys AI-driven retail, fitness tracking, and digital marketing solutions from startups.

- Red Bull – Contracts startups in extreme sports tech, esports, and branded media innovation.

- Spotify – Uses AI-driven recommendation startups to enhance its music algorithms.

- Netflix – Engages startups in media production, content analytics, and AI-driven engagement tools.

- Tesla – Purchases clean-tech and battery-tech innovations from startups to push forward electric vehicle advancements.

These brands illustrate how startup-client relationships extend beyond traditional enterprise tech, reaching lifestyle, entertainment, and mobility sectors.

Final Thoughts: What This Means for Startups & Corporates

- Startups are critical service providers: The world’s biggest companies are actively purchasing startup solutions, reinforcing the importance of B2B collaborations.

- Tech giants remain dominant clients, but industrial, fintech, and consumer brands also play a major role.

- Startups should strategically target corporates that align with their industry, as data shows clear patterns in industry and regional preferences.

As corporate-startup collaborations grow, this ecosystem presents vast opportunities for both sides—startups gain major clients, while corporates drive innovation by sourcing cutting-edge solutions from emerging companies.

This analysis uncovers the deep relationships shaping today’s startup economy, and the trends defining the future of global innovation.

Unlock Deeper Insights with Specter

This is just the tip of the iceberg. At Specter, we offer unparalleled insights into corporate-startup relationships, helping you understand which companies are the most engaged clients for startups in your industry.

🚀 Want to explore more data and insights? Get in touch with us to schedule a demo and see how Specter can empower your business with real-time intelligence.