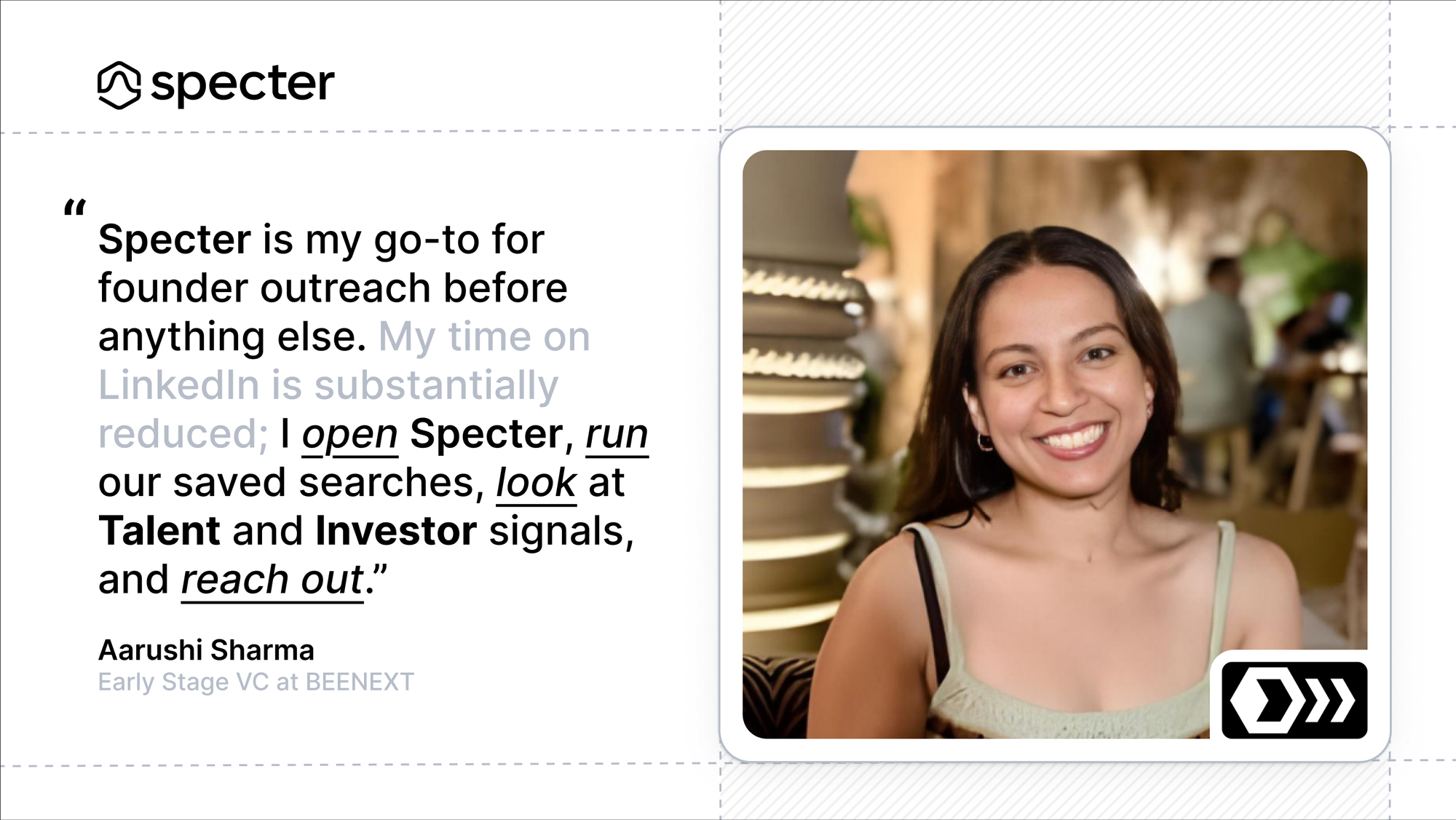

Specter is my go-to for founder outreach before anything else. My time on LinkedIn is substantially reduced; I open Specter, run our saved searches, look at Talent and Investor signals, and reach out

Where BEENEXT starts from

Aarushi began her investing career at Bertelsmann’s India arm before moving to earlier stages at BEENEXT to build relationships when teams are still forming. The fund is sector‑agnostic but concentrated where technical leverage matters: fintech, SaaS and AI, B2B commerce, deep tech and ConsumerTech. The mandate also includes Indian‑origin founders building globally, particularly relevant for operators who have scaled in India and relocate to the US to build.

A lot of our older companies have become talent hotspots. Founders keep referring to team members who are now starting up to us.

The bottleneck in early‑stage sourcing

Early‑stage VC is a timing game. At pre‑seed and seed there is rarely a press release, and a “stealth” LinkedIn update tells you little about who deserves a call today versus next month. Before Specter, the team’s workflow looked familiar: LinkedIn Sales Navigator for discovery, Tracxn for context once a company became legible, and a steady stream of warm introductions. It produced names, but not a clear order of operations.

Even if we saw stealth companies on LinkedIn, it was hard to decide who to reach out to first, who to give more importance to.

That line captures the prioritisation problem. The team could see activity but not rank it. Diaspora targeting added another layer: isolating Indian‑origin founders in the US with proxy filters, alma maters, past employers, was brittle and time‑consuming. Meanwhile, the work itself happened in short daily bursts. Thirty minutes here, ten minutes there, and a constant background worry about missing a narrow window when a founder is most open to a new relationship.

In the US we back Indian‑origin founders. On LinkedIn it was very difficult to filter just for that. Specter’s combinations actually surface them.

The inability to segment precisely meant good leads often sat next to noise; Specter’s filters promised a way to separate the two.

Signals to motion

We want to meet people when they’re just leaving or still thinking, when they’ve quit or are about to. Instead of meeting them when everyone already knows they’re starting up.

Specter flipped the starting point from the social graph to signals. The team now encodes a thesis into filters: role history, geography, funding type, repeat‑founder tags and relies on Talent Signals to catch people in the pre‑stealth moment: career breaks, fresh role endings, or profiles that show an end date without a new title yet. Showing up pre‑announcement turns a cold message into the first line of an ongoing conversation.

When investor interest spikes, it’s an SOS for us. Ideally, we should have spoken to those founders already.

When timing is tight, Specter’s Investor Interest Signals act like a pager. A sudden rise in investor attention is not a curiosity; it’s a coverage check. The rule is simple and useful: if the market is leaning in, the team wants to be in the thread, fast. That shared norm tightened response times and removed the guesswork that used to sit in everyone’s head.

A weekly cadence that compounds

It’s less about the minutes saved; Specter freed up headspace. I block two hours on Friday instead of worrying every day whether I missed someone.

The shift to signals made it possible to redesign the week. Instead of constant context‑switching, the team now runs sourcing as a two‑hour Friday block that plans the following week’s outbound. Specter is the first tab. Saved Searches hold the theses they revisit; shared Lists carry context from conversation to conversation so anyone can see who was contacted, who was starred and why. The cadence is light but consistent, and it compounds.

Adding new nodes to the network

You really need a big top of the funnel if you’re not based in that geography 100% of your time, Specter helps us keep adding good founders and operators to the network.

Specter isn’t only about catching rounds; it’s about compounding the community. By surfacing pre‑stealth leavers and diaspora operators, the team continually introduces new people into a cross‑regional web (India, Japan/SE Asia, US). Those nodes become referrers, customer intros and sounding boards for validation. Investor‑interest spikes provide coverage discipline: “we should already know this team”—but most of the value appears earlier: warm conversations before a company has a name, and follow‑ups that move naturally from “just left” to “now building.”

We keep adding newer people to the network so everyone continues to derive value from it.

The market context and how the team adapted

Across India, early‑stage decision‑making for smaller cheques has become more decentralised, and timelines have compressed. That shift changes what “good sourcing” looks like. It is no longer sufficient to meet a founder when whispers become general knowledge.

We’ve moved closer to the moment of company creation, tracking ESOP vesting, deepening angel relationships, and using Specter to meet people just as they step out of previous roles.

The adaptation is straightforward: arrive while the narrative is still being written, then compound that proximity with a community that can help validate and open doors across regions.

What’s next in the stack

Specter sits at the top of the funnel: it finds people, ranks urgency, and turns signals into shortlists. From there, BEENEXT hands off to the rest of their workflow—CRM, notes, and diligence, so context isn’t lost as conversations deepen.

We want to do more automations with Specter, and the next CRM has to plug in.

Today, the team is transitioning CRMs. Their previous Airtable connection is paused during the move, but the requirement for the next system is clear: bi‑directional sync with Specter lists and searches so every outreach, star, and note has a home. Light Zapier automations are already in play for quick pushes and reminders. For diligence and memo drafting, the team, like most of the market, leans on OpenAI/Claude to accelerate write‑ups once they’ve met a founder. LinkedIn and Tracxn still appear, but as supporting context rather than the starting point.

Where the stack is headed is more ambitious: an agentic CRM that nudges reconnections across the network, auto‑logging of meetings and emails into the right record, and lead scoring that blends Specter’s Talent/Strategic signals with the team’s own thesis markers. On the build side, they’re exploring Specter’s API to power internal tools, everything from list hygiene to custom alerts, so the sourcing loop keeps getting tighter.

Closing the loop

BEENEXT’s edge has always been proximity to builders and the ability to feel change early. Specter gives that instinct a system: encode a thesis, watch the right signals, and turn pre‑stealth moments into first conversations week in, week out. The result is a calmer, more confident sourcing motion that fits a lean team and a faster market.

Specter lets us show up pre‑announcement, not post‑hype.

As a thought experiment, Aarushi imagines an offline week in Bangalore’s HSR cafés, meeting people where the first lines of code are written. It’s a fitting metaphor for how the team operates even when the internet isn’t down: stay close to the community, and be there before the story is public. Specter is the digital expression of that habit, widening the aperture to new operators and angels without drowning the team in noise.

Put simply: BEENEXT now runs on signal, not serendipity. And while the stack around Specter will keep evolving, the core loop is already in place: find earlier, prioritise better, and build relationships that compound.