Every year, Data-Driven VC thoughtfully compiles an excellent overview of the data-driven VC landscape based on 300+ community submissions. This unique report sheds light on 235 leading VC firms, 100 thought leaders, and their preferred tools.

The 2025 DDVC Landscape is full of interesting highlights. At Specter, we have decided to highlight interesting findings from the perspective of a data vendor.

Data Vendors at the Heart of the DDVC Shift

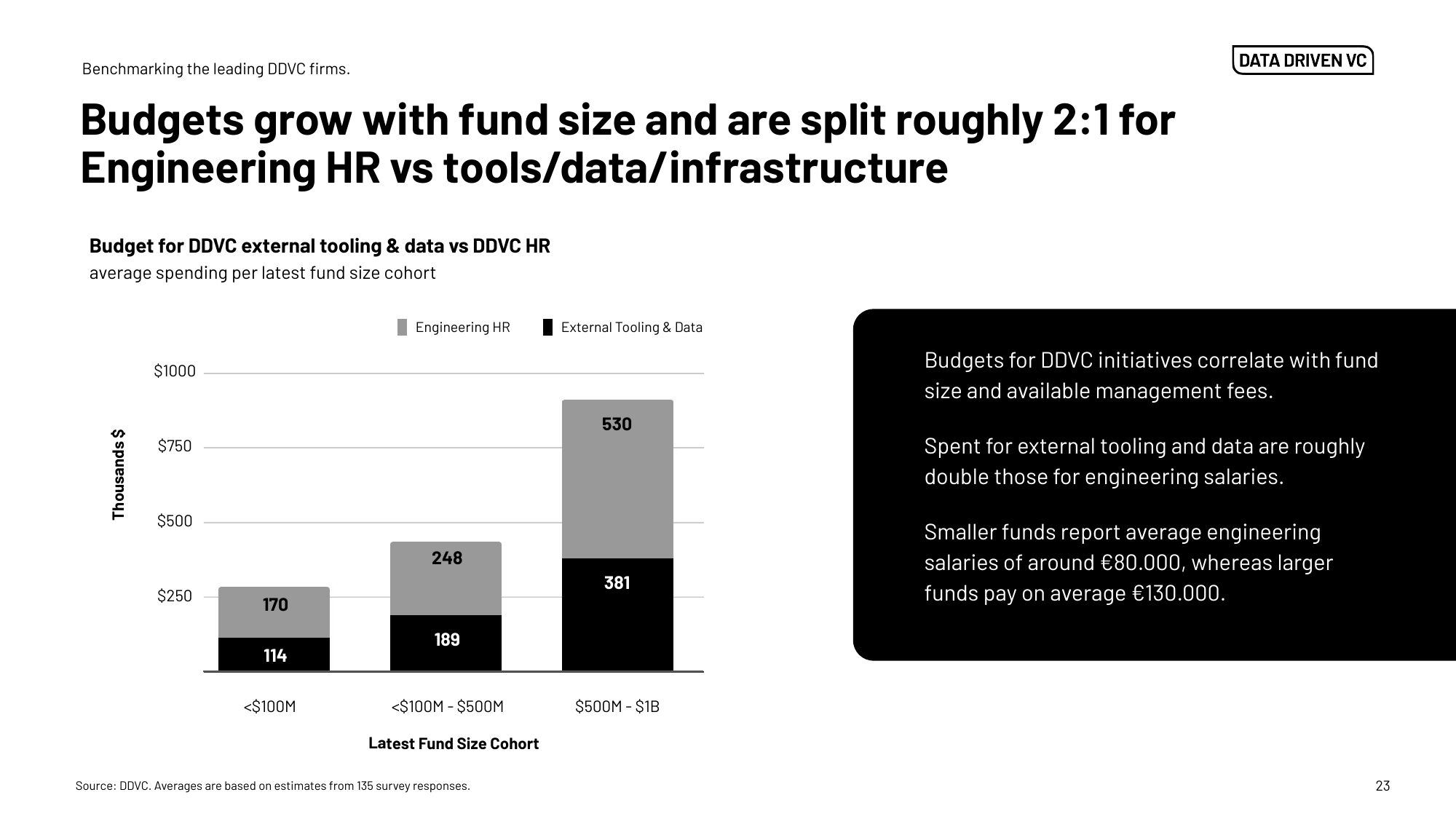

1. Budgets Keep Tilting Toward External Data & Tools

VCs now spend roughly 2 × more on third-party data, SaaS and infra than on engineering salaries, across every fund-size cohort. We interpret this as a pretty clear “buy before you build” signal.

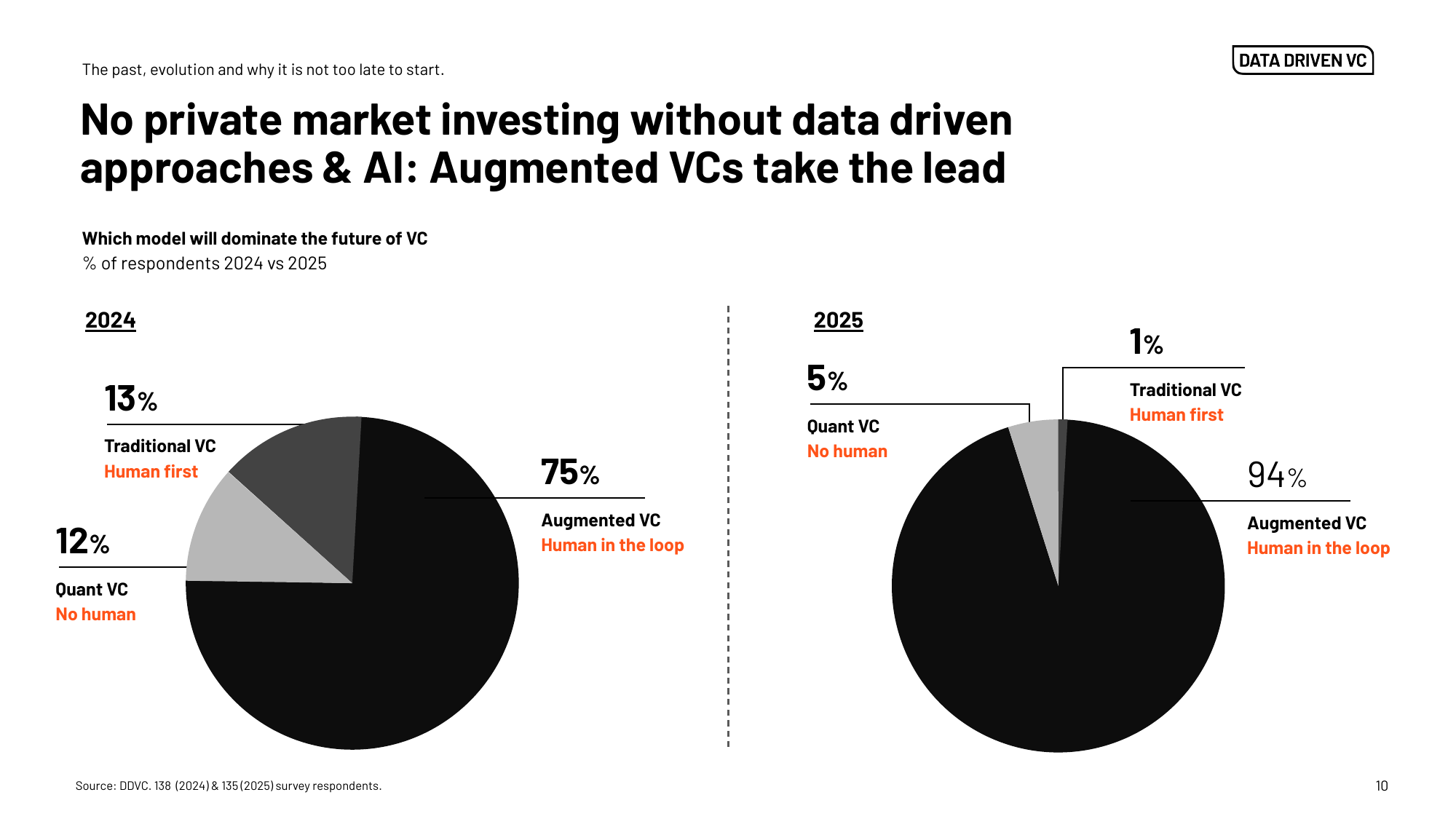

2. “Augmented VC” Has Won the Operating-Model Race

In 2025, a decisive 94 % of firms say the future is “human-in-the-loop,” while fully quant and traditional models fade. Platforms that support investors, rather than replace them, now align with the dominant mindset.

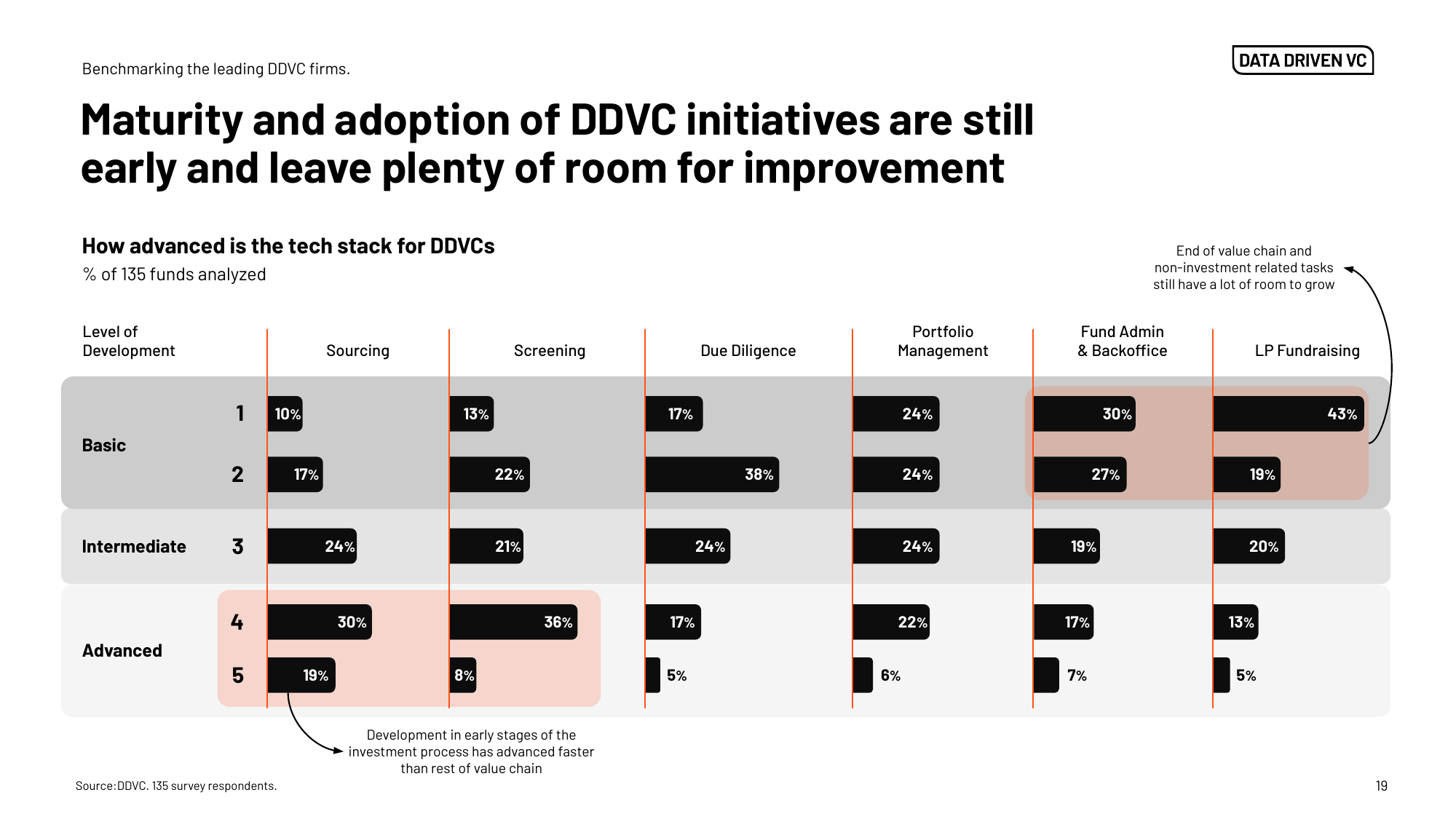

3. Maturity Gaps = Opportunity White-Space

Early-stage steps (sourcing and screening) are already advanced for ~50% of DDVCs. Yet, DD, LP reporting, fund administration, and portfolio operations remain “basic” for ~70%.

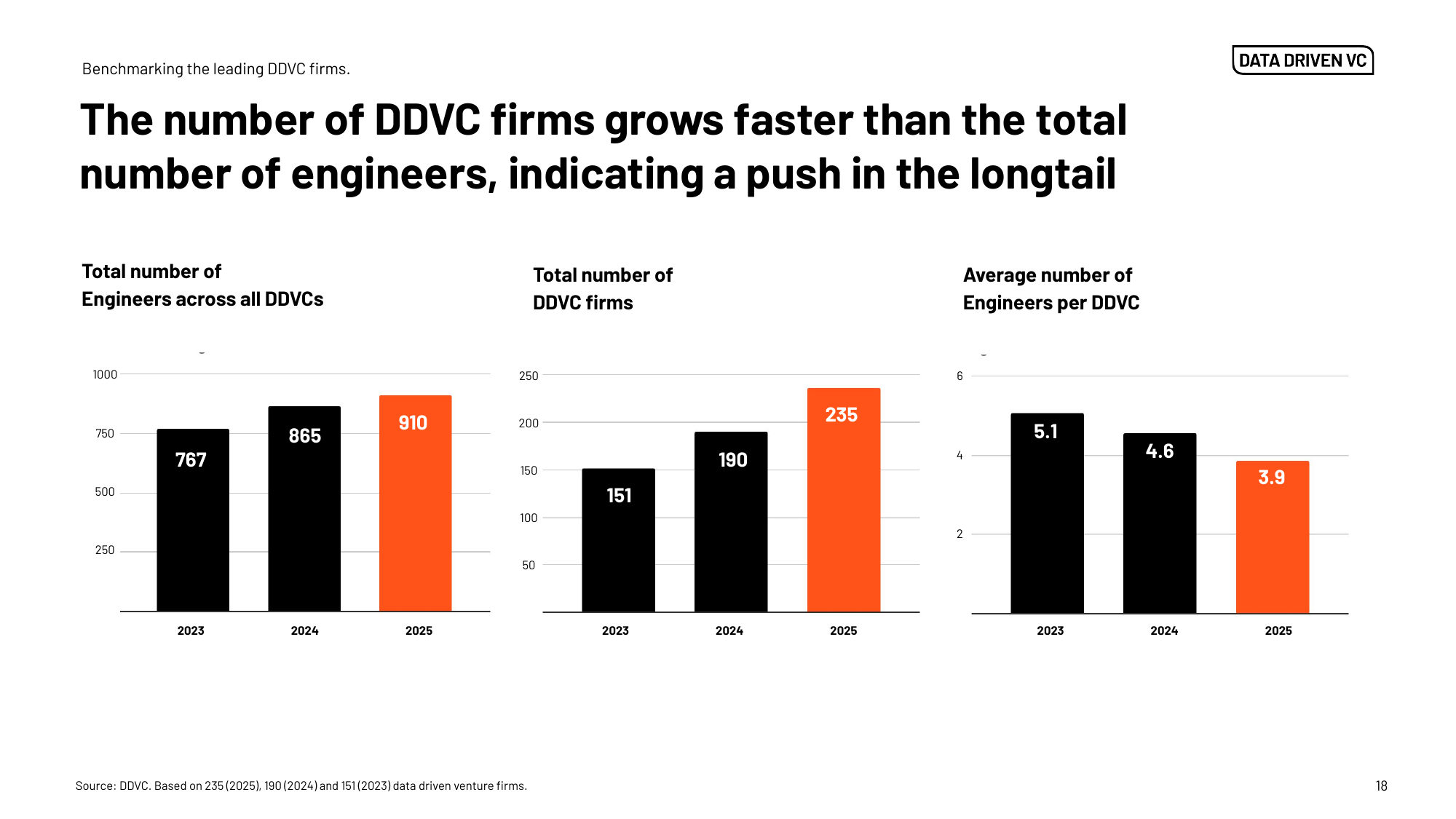

4. Long-Tail Adoption Is Accelerating

The community grew from 151 to 235 DDVC firms in two years, yet average engineering headcount fell from 5.1 → 3.9. More funds enter the data game, but companies lean on vendors instead of hiring in-house development teams.

5. Summary of Our Takeaways

Integrations & partnerships beat feature creep.

Offer clean APIs/web-hooks so VCs can unify 1st- & 3rd-party data.

Make your data agent-ready (structured JSON endpoints, clear licensing).

Enrichment that can’t be scraped is the new moat.

We’ve already incorporated many of these insights into our Q1 and Q2 roadmap, so it’s reassuring to see our direction reaffirmed.

TL;DR

Data-driven VC is no longer a fringe approach—it’s become the default. Budgets are increasingly allocated to external data, and augmented workflows now define how top firms operate. Yet, there remains significant white space—for both investors embracing DDVC and the vendors supporting them. The real winners will be those vendors who integrate seamlessly, deliver differentiated insights, and empower agent-centric, automated workflows.