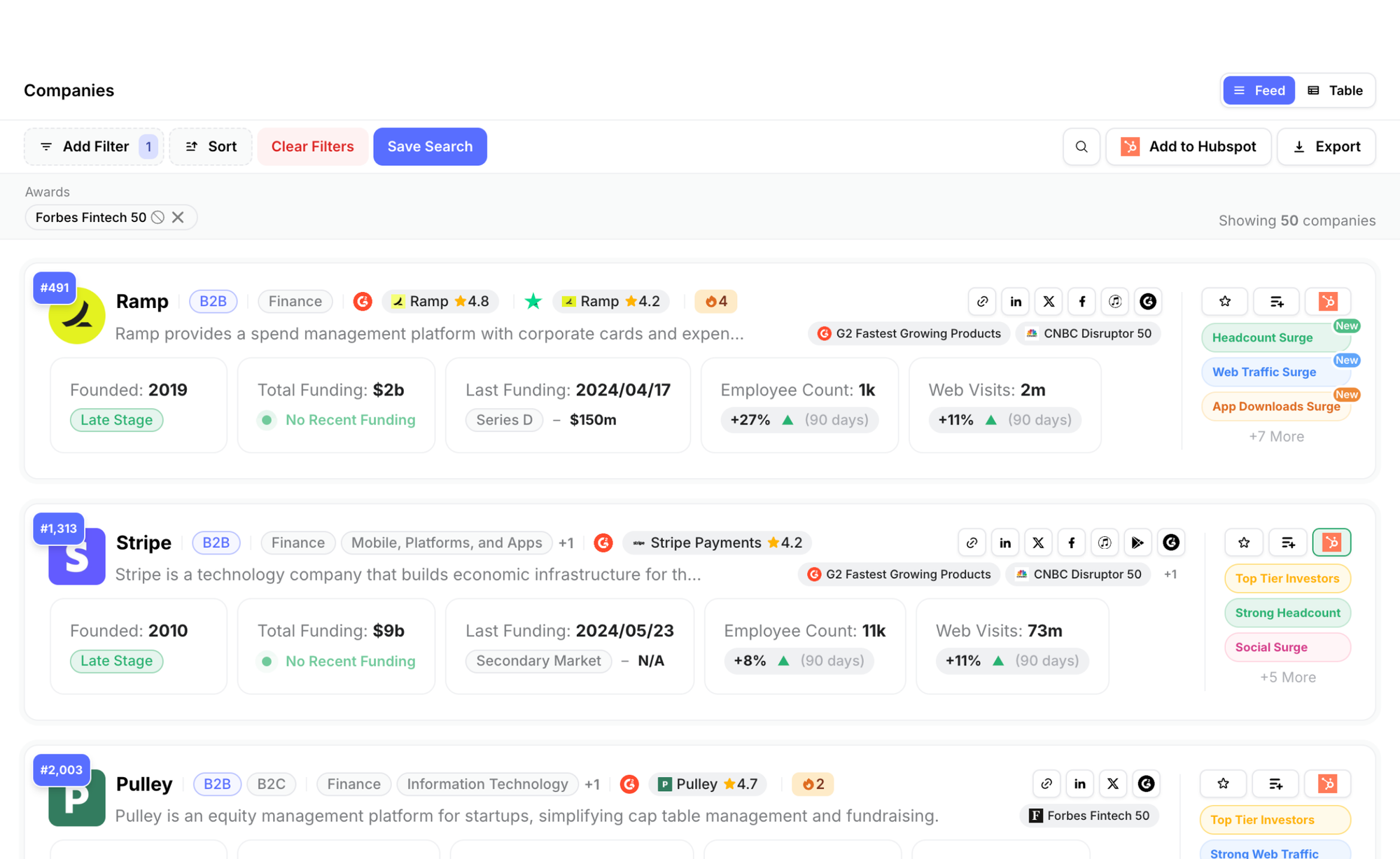

Each year, Forbes Fintech 50 highlights the most innovative and high-potential financial technology startups reshaping the industry. From payments and lending to wealth management and fraud prevention, this year’s list features both early-stage disruptors and well-funded scale-ups, reflecting the rapid evolution of fintech.

To deliver the most comprehensive profiles, we aggregated data from multiple sources—tracking funding, traction, and market impact. Beyond core metrics, we also monitor the awards and recognitions these companies earn from pre-seed to exit, capturing the milestones that define their journey.

Curious about who’s shaping the future?

- Already using Specter? Click here to explore the Forbes Fintech 50 🤖

- Not on Specter yet? Download the list below, and if you’d like to access the fully enriched data, get in touch with us here 📥

Early-Stage Fintech Innovators

(Seed to Series A – Disrupting Traditional Finance with Bold New Ideas)

Pulley – The Future of Equity Management

Pulley is redefining cap table management, helping startups navigate equity planning and stock issuance with ease. With $42 million in total funding, Pulley is a rising player in the startup finance ecosystem.

Kudos – Smarter Credit Card Optimization

Kudos is leveraging AI to maximize cashback and rewards for users across multiple credit cards. The platform integrates seamlessly with e-commerce checkouts, and with rapid growth in web traffic, it's poised for mass adoption.

DataSnipper – AI-Powered Financial Documentation

Amsterdam-based DataSnipper is making waves in audit automation, providing accountants and finance teams with AI-powered document processing. With notable LinkedIn engagement growth and high user retention, it's streamlining compliance workflows worldwide.

Mid-Stage Fintech Leaders

(Series B to C – Scaling and Expanding Market Share)

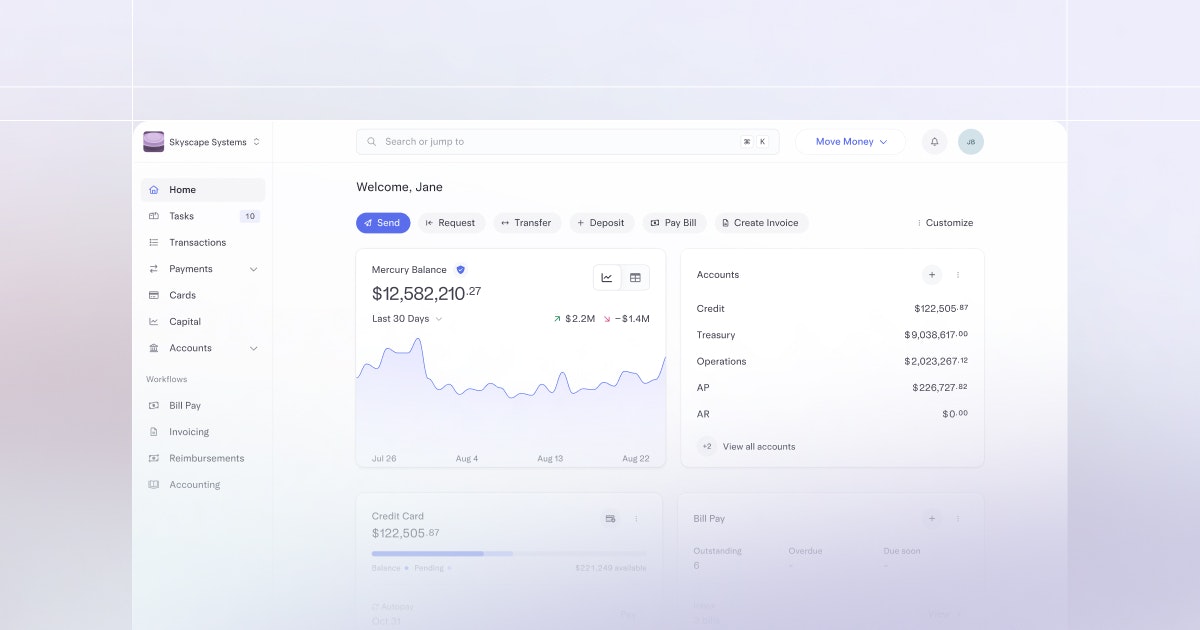

Mercury – The Bank for Startups

Mercury continues to dominate the startup banking space, with its AI-driven financial tools helping founders manage expenses, runway, and venture funding. A steep increase in monthly web traffic and funding rounds signals strong demand for its services.

Persona – Identity Verification Reinvented

As fraud prevention becomes a top priority, Persona is leading the charge with its adaptive identity verification platform. Backed by high-profile investors and securing $200M+ in funding, it's quickly becoming a go-to solution for fintech compliance.

Coalition – Cyber Insurance for the Digital Age

With data breaches and cyberattacks surging, Coalition is offering AI-powered risk management and cyber insurance solutions to enterprises. The company has seen strong revenue growth and a rapid increase in corporate clients, making it a standout in the insurtech sector.

Late-Stage Fintech Titans

(Series D and Beyond – Dominating and Defining the Industry)

Stripe – The Payment Giant’s Next Chapter

A perennial fintech leader, Stripe continues to dominate with its global payments infrastructure. With billions in total funding and massive enterprise adoption, Stripe remains an anchor of the fintech world.

Chime – The Digital Banking Powerhouse

Chime’s fee-free banking model has propelled it into the mainstream, with millions of active users and rapid customer acquisition. Its continued success challenges traditional banks, making it one of fintech’s most influential players.

Plaid – The Data Connectivity King

As open banking grows, Plaid is strengthening its foothold in financial data aggregation, connecting millions of users to apps like Venmo, Robinhood, and Coinbase. With global expansion and deep partnerships with major financial institutions, Plaid is cementing itself as a fintech backbone.

The Future of Fintech

From AI-powered identity verification to startup banking, the Forbes Fintech 50 companies are reshaping financial services. As these startups scale, we’ll continue to see faster transactions, improved security, and smarter financial products tailored to consumers and businesses alike.

🚀 Stay tuned—fintech is just getting started.