In a world where venture success increasingly hinges on speed, precision and purpose, Giant Ventures has quietly built a playbook that marries all three. Founded in 2019 in London, Giant is a multi-stage, thesis-driven venture firm on a mission to back technology founders building purpose driven businessesIn early 2024, they closed two new vehicles, totalling $250 million—a $100 million Seed II fund targeting 25 early-stage climate, health and economic mobility startups, and a $150 million Climate Growth Fund to bridge the critical Series B funding gap for scaling climate tech champions.

But beyond the headlines and high-profile portfolio companies, Giant’s operational rigour—its relentless focus on structuring, centralising, and activating data—is delivering the real edge.

The Architects of Giant’s Data Engine

Lucy Brady, Head of Product, arrived with a singular brief: “Figure out how technology and data can improve the way we build and run a venture capital firm.” Her résumé spans First Round Capital, the Obama White House, and Oscar Health (now public), and today, she oversees everything from CRM strategy to portfolio-ops tooling.

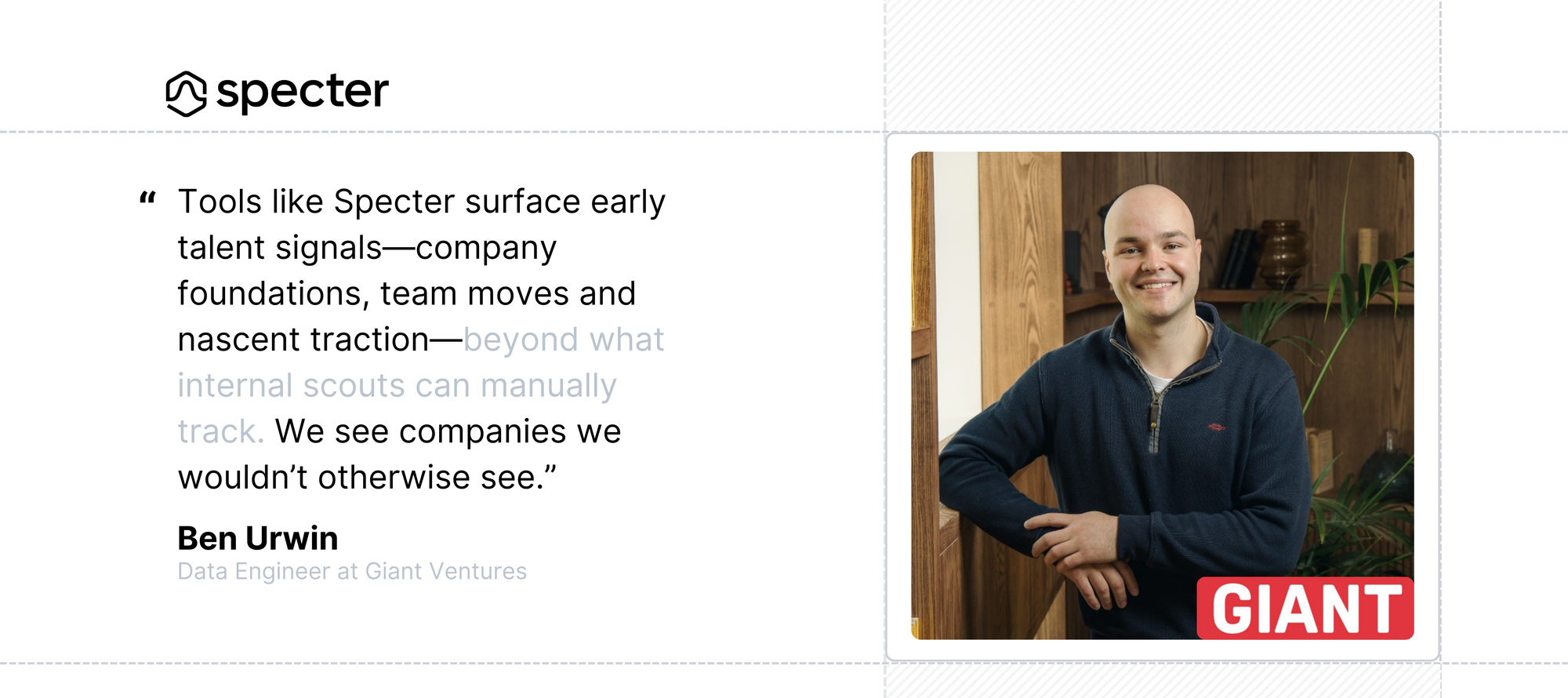

Working alongside her is Ben Urwin, Senior Data Engineer, who has stitched together pipelines that transform hours of manual research into instant, actionable dashboards and reports in just seven months. A former financial engineer and Blackstone-backed music-investment technologist, Ben’s expertise ensures that every raw data point—from talent signals to deal histories—flows through a unified platform.

Data as the Venture Compass

Giant’s data philosophy is elegantly simple: embed it at every stage of the investment lifecycle to free up time for getting to know and supporting founders.

- Sourcing.

- Tools like Specter surface early talent signals—company foundations, team moves and nascent traction—beyond what internal scouts can manually track.

- “We see companies we wouldn’t otherwise see,” says Ben.

- Due Diligence.

- Automated tools generate comprehensive competitor reports by integrating first-party historic deal-flow data with third-party insights from platforms like Specter.

- A single pane surfaces prior interactions—why past deals were passed or pursued—to sharpen early assessments.

- Portfolio Management.

- Live dashboards consolidate performance metrics, cap-table movements, and operational milestones, keeping investors and founders aligned while streamlining reporting to LPs.

“The first hurdle is entity resolution—creating a single, unified view of every company and individual. The second is signal generation—extracting actionable insights from that unified dataset.” explains Ben.

Build vs. Buy: A Pragmatic Hybrid

Rather than chase a fully bespoke data warehouse straight away, Giant adopted a phased, hybrid approach:

- CRM as “Source of Truth.”A best-in-class CRM houses every company, contact and deal‐flow record.

- Custom Back-End Entity Resolution. Behind the scenes, data pipelines reconcile names, domains, and deal histories across various data sources, surfacing a single unified view in the CRM.

This modular mix of first and third‑party data powers actionable insights now—and makes it easy to plug in new sources as they emerge.

Spotlight on Portfolio Breakouts

- Haven Energy. Sticky processes and state-utility pipelines make this clean-power startup a textbook climate-tech winner.

- Doccla. Virtual hospital wards that enable early discharge and remote monitoring, reducing healthcare costs and easing pressure on hospitals during peak demand.

- Arbol. AI-powered parametric insurance delivering instant, data-driven payouts for climate risks across agriculture, energy, and infrastructure.

Each of these companies exemplifies Giant’s thesis—impact × scale—backed by data insights that accelerate decision cycles and deepen founder support.

Giant’s Call For Startups

Are you building the next big thing in tech? Giant wants to hear from you!

Two Hot Focus Areas:

- Data Center Optimization: From energy efficiency to cooling innovation, help reshape the backbone of the digital world.

- AI for Materials Science Development: Leverage machine learning to design next-gen materials, from ultra-light composites to self-healing polymers.

👉 Whether you’re perfecting your MVP or gearing up for Series B, Giant is ready to team up—let’s talk!

Culture, Adoption & the Human Factor

Even the most powerful data stacks are only as good as those using them. Lucy underscores a core truth: “embedding a culture of behavioural change is one of the most important aspects of becoming a truly data-driven firm”. Giant drives adoption by:

- Top-Down Endorsement. Partners and senior investors model data-driven workflows.

- Low-Friction Entry. Automated pitch-deck ingestion, simple data-capture forms and community feedback loops “lower the bar” for consistent, high-quality inputs and add immediate value to the core users.

- Continuous Training. Regular “data office hours” and informal drop-ins ensure that every team member can access dashboards and query pipelines.

The result is a culture where data isn’t a back-office luxury but a shared asset fueling every investment thesis.

Navigating Real-World Challenges

Despite a robust framework, Lucy and Ben face two enduring questions:

- Coverage. “Are we seeing everything?” Early-stage discovery—especially pre-founder signals—remains a nuanced challenge. Proprietary parameter-setting and custom signal-generation will be key to closing the gaps beyond what off-the-shelf tools provide.

- Clarity. With 700,000+ funding rounds in Specter alone, filtering for relevance is non-trivial. Today, teams set their own filters; tomorrow, Giant plans to bake richer thematic and signal-driven curation directly into the tools they build.

The Road Ahead: APIs & AI Agents

On the immediate wishlist:

- Specter API Access. Q2 launch of Specter’s API suite promises real-time interoperability—automated talent and funding feeds into Giant’s internal tools.

- AI-Powered Assistants.

- Deal‐Flow Briefers: Automated email summaries that spotlight key context for upcoming meetings.

- Portfolio Q&A: Natural‐language queries over live data, from valuation histories to milestone trends.

- Thesis Ideation Engines: AI-augmented exploration of verticals, competitor maps and investment themes, seeded by Giant’s curated data lake.

“Our late-mover advantage is stitching together OpenAI models, Specter’s data and our own pipelines into a single, ever-smarter investment engine,” says Lucy.

Lessons for the Modern Investor

Giant Ventures’ journey offers a clear blueprint for VCs and LPs:

- Operationalize First. Build a reliable “single pane” of essentials before chasing exotic datasets.

- Stage-Tailor Your Data. Pre-seed needs people signals; growth-stage demands company performance metrics. Separate pipelines keep insights sharp.

- Plan for Scale. Balance integration speed with long-term infrastructure quality and data governance.

- Embed Behavior Change. Champion data workflows from the top and lower friction for your team.

- Iterate Relentlessly. Coverage and clarity are moving targets—tackle them with creativity and continuous refinement.

By aligning purpose, process and precision, Giant Ventures is not just funding the next wave of climate, health and economic mobility pioneers—it’s redefining what it means to be a truly data-first, impact-focused venture firm.