YC isn’t just an accelerator; it’s where scrappy ideas turn into real companies. Think Airbnb and Stripe, then think thousands more. Leveraging Specter data of historical YC founders plus recent batches, we mapped where people come from (via education/language), where they studied, who they worked for before YC, and what they’re building now.

Want a deep dive? Get the downloadable list below—profiles, career arcs, and batch details included.

🍊Get Y Combinator Alumni Lists:

Geographic Origins: Global Shift Accelerates

Looking at where founders first studied and the languages they grew up with, about 50% trace back to the US, 30% to Asia, 12% to Europe, and 8% to LATAM/Africa—think English-dominant US schools; Mandarin/Hindi and IIT/NUS roots; multilingual French/Spanish in Europe; and Shona speakers from Ghana/Zimbabwe.

Takeaway: Globalization surges, with Asia's tech talent boom, but US retains edge via ecosystem pull.

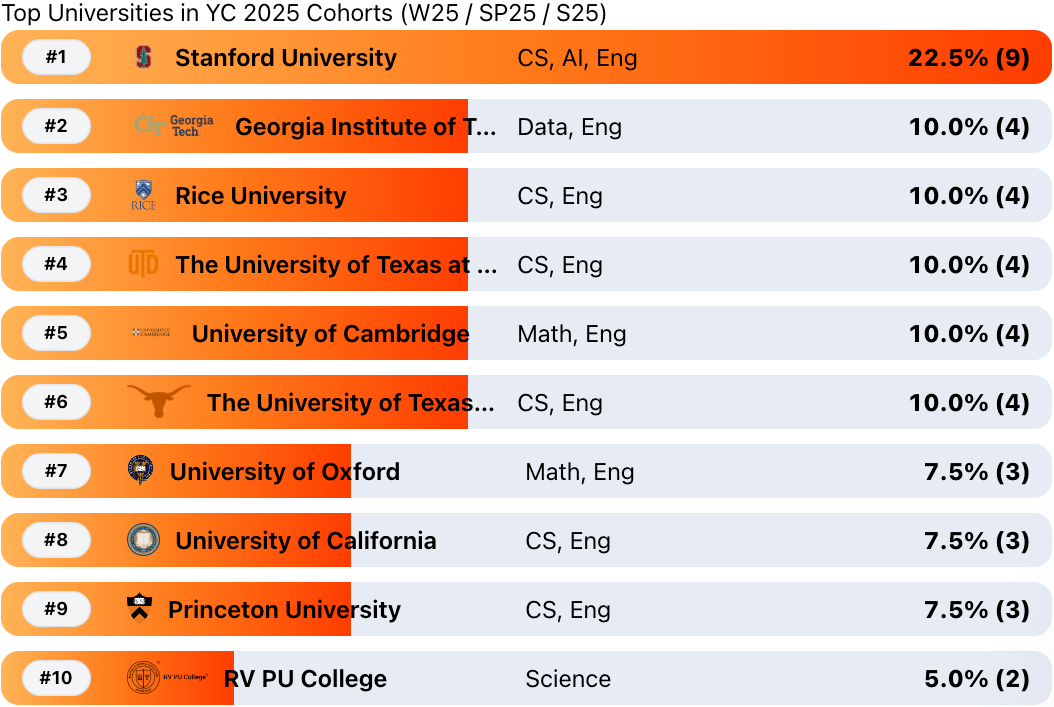

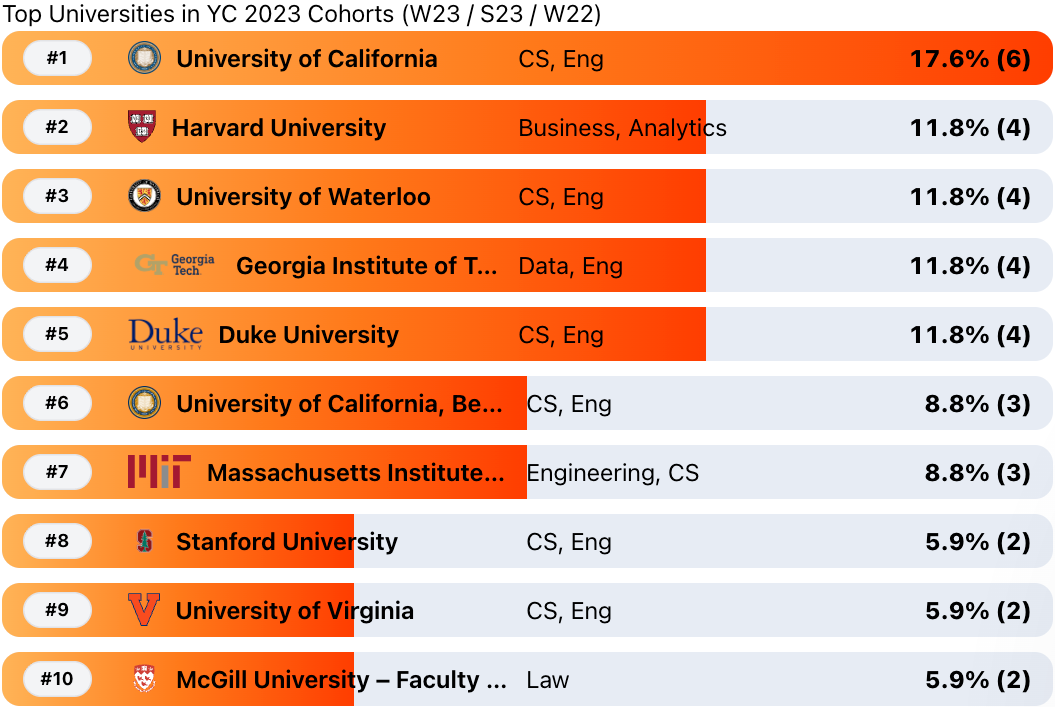

Top Universities: Elite, Increasingly International

Top 10 by university alumni (CSV + batch trends), favoring CS/MBA programs:

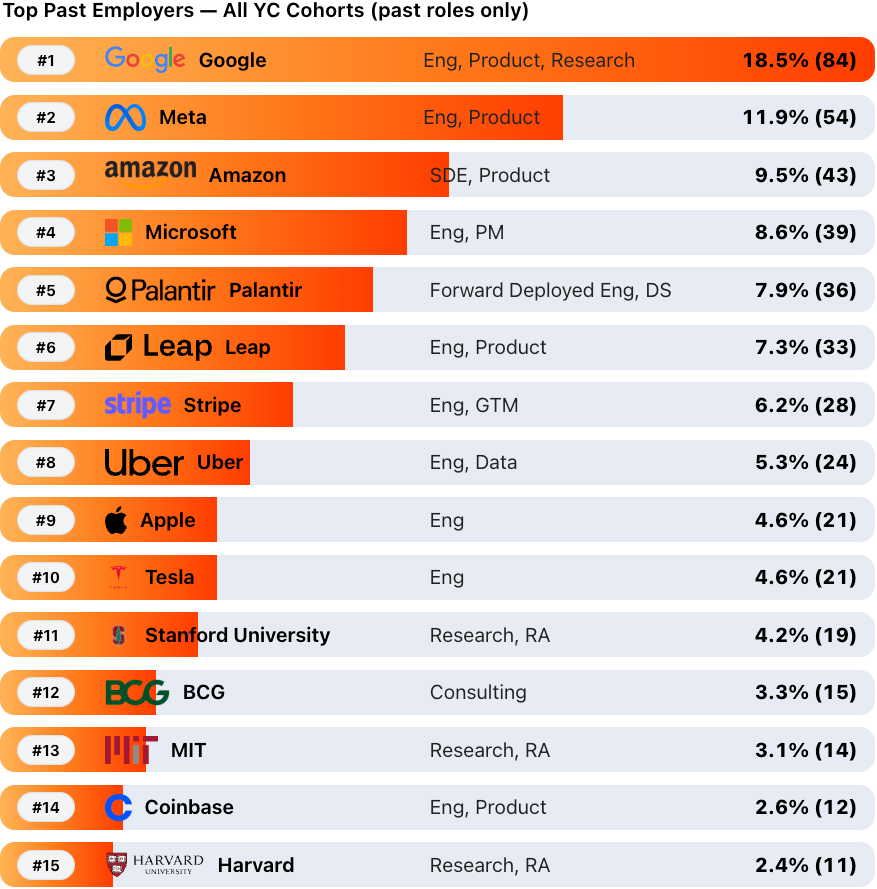

Top Past Employers: Tech Giants Dominate Pipeline

Top 15 by frequency, emphasizing engineering/consulting:

Industry Focus: AI Explodes, Fintech/Health Persist

In 2025 (W25/SP25/S25) we see 466 companies vs 495 in 2023. The mix shifts, not the momentum. B2B still dominates—65% in 2025 (303/466) vs 68% in 2023 (337/495)—but what’s inside that bucket changes. Industrials jumps from 2% → 9%, a hard-tech/robotics/ops wave. Fintech cools (9.5% → ~5.6%), and Healthcare eases (10.3% → 7.7%).

Consumer is steady (6–7%), Education doubles but stays small (1.2% → 2.6%), Real estate is flat (2%), and Government ticks up from a rounding error to ~1.5%.

AI is now the default ingredient—most of those teams show up under B2B or Industrials rather than a standalone “AI” tag.

Standout Successes: One MVP Per Batch from Last 8

- S21: HitPay – Revolutionized SME payments in Southeast Asia, scaling to millions in transactions. Founders: Aditya Haripurkar (CEO, ex-Zipmark COO with fintech expertise), Nitin Muthyala (CTO, engineering background in scalable systems).

- W22: Jumpwire – Secured sensitive data with push-button encryption; acquired by WorkOS for seamless enterprise integration. Founders: Ryan Cooke (ex-Google engineer focused on security), William Huba (data privacy specialist with YC W22 experience).

- S22: Supabase – Open-source Firebase alternative; raised $80M and hit 1M+ users for backend-as-a-service. Founders: Paul Copplestone (CEO, full-stack developer with prior startup exits), Ant Wilson (CTO, AI and database expert).

- W23: Perplexity AI – AI-powered search engine; valued at $18B after raising $100M for conversational answers. Founders: Aravind Srinivas (CEO, ex-OpenAI researcher), Denis Yarats (CTO, ML specialist from Meta), Johnny Ho (engineering lead), Andy Konwinski (co-founder, Databricks background).

- S23: Replicate – Democratized ML models; raised $40M Series B to run open-source AI in the cloud. Founders: Ben Firshman (CEO, ex-Docker CTO with open-source expertise), Andreas Jansson (CTO, AI infrastructure specialist).

- W24: Agentnoon – AI workforce planning; secured $6M seed for HR optimization. Founders: Ali Nawab (CEO, AI/ML innovator from Google), Dave Y. Kim (co-founder, data geek with transformation experience).

- S24: Marr Labs – Human-like AI voice agents; transformed customer service with undetectable bots. Founders: Dave Grannan (CEO, AI/ML pioneer from Vlingo/Siri), Han Shu (CTO, voice tech expert).

- W25: Misprint – Pokémon cards marketplace with bid/ask system; $40K monthly revenue in $3.5B market. Founder: Eva Herget (ex-Goldman Sachs trader turned full-time card seller). Cofounder/CTO: Jonathan Jenkins (Research @ Carnegie Mellon University)

Conclusion: AI Drives YC's Next Era

YC founders are educated risk-takers: Elite degrees fuel their boldness, geographic diversity hints at globalization, and patterns like international moves predict who thrives. 2025's agentic AI surge hints at faster unicorns, with Asia/Europe influx challenging US dominance.

Download the full enriched list here to explore 30+ fields yourself—perfect for investors scouting talent or aspiring founders benchmarking. Expect AI/climate hybrids; could Spring 2025 spawn the next Perplexity?

Disclaimer: Based on Specter data. Traits are correlative, not causative—YC success demands hustle above all.